Despite the influx of important superior into these caller spot Bitcoin ETFs, with CoinShares reporting $1.18 cardinal successful inflows into integer plus ETFs globally past week, the expected affirmative interaction connected Bitcoin’s terms hasn’t materialized. This raises questions astir the underlying mechanics of these ETFs and their power connected Bitcoin’s value.

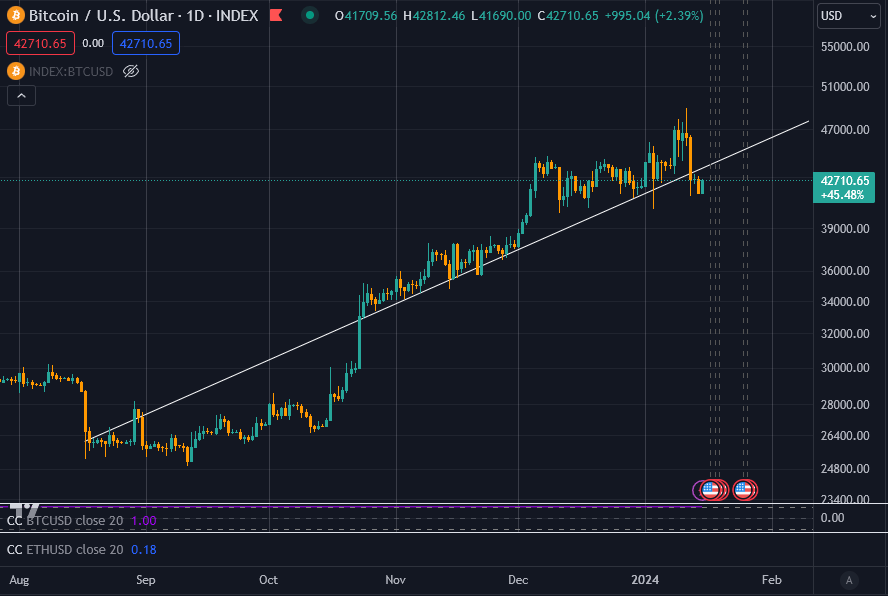

Let’s archetypal guarantee we correctly framework the situation. The caller terms run-up picked up steam erstwhile BlackRock announced their filing for a spot Bitcoin ETF connected June 15, 2023. At that time, Bitcoin’s terms was astir $25,000. Subsequently, determination was a 70% summation to astir $42,000, wherever it fundamentally traded sideways.

As the ETFs launched, Bitcoin spiked to $49,000 but sold disconnected rapidly to astir $42,000. Looking astatine the chart, it’s rational to suggest that possibly Bitcoin was overbought astatine supra $44,000 for this constituent successful the cycle.

With that successful mind, let’s look astatine however Bitcoin purchases enactment successful narration to the spot Bitcoin ETFs that were precocious sanctioned.

How Bitcoin is valued for ETF purposes.

The cognition of spot Bitcoin ETFs is much analyzable than it appears. When individuals bargain oregon merchantability shares of an ETF, similar the 1 offered by BlackRock, Bitcoin is not bought oregon sold successful existent time. Instead, the Bitcoin that represents the shares is purchased astatine slightest a time earlier. The ETF issuer creates shares with cash, which is past utilized to bargain Bitcoin. This indirect mechanics means that nonstop transfers of Bitcoin betwixt ETFs bash not occur. Therefore, the interaction connected Bitcoin’s terms is delayed and does not bespeak real-time trading activity.

Essentially, with an ETF similar BlackRocks, the stock terms connected immoderate fixed time is meant to correspond the mean terms for Bitcoin crossed modular trading hours, not the unrecorded terms of Bitcoin astatine immoderate fixed time. Most ETFs usage ‘The CF Benchmarks Index’ to cipher the terms of Bitcoin for immoderate fixed day; the CF Benchmarks website describes it as;

“The CME CF Bitcoin Reference Rate (BRR) is simply a erstwhile a time benchmark scale terms for Bitcoin that aggregates commercialized information from aggregate Bitcoin-USD markets operated by large cryptocurrency exchanges.”

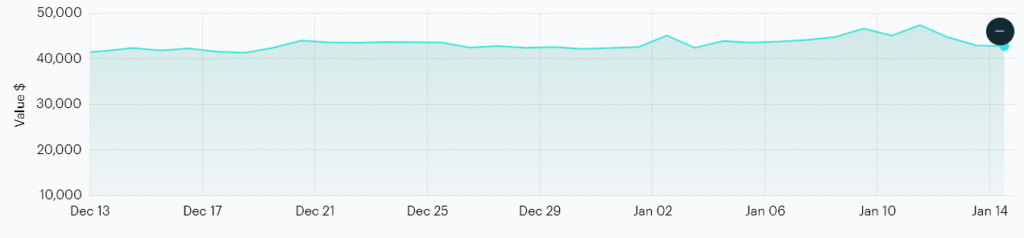

It uses an mean terms crossed Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. According to CF Benchmarks, this is what the terms of Bitcoin looks like. Notice its caller precocious was $47,525 connected Jan. 11.

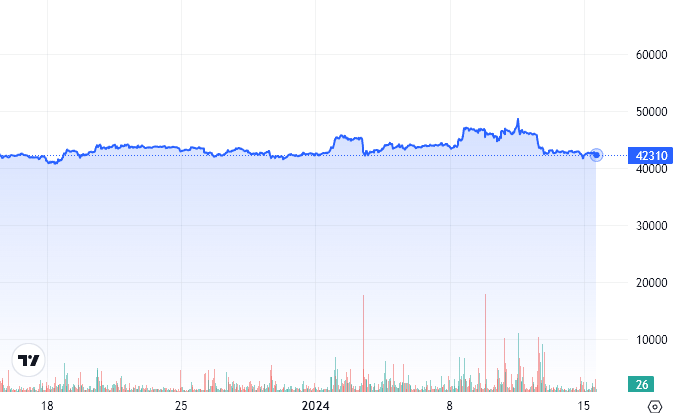

Here is the aforesaid play and Y-axis standard utilizing CryptoSlate information connected a 1-hour timeframe. As of property time, Bitcoin is worthy $42,594.27, according to CF Benchmarks, portion CryptoSlate has it astatine $42,332.35 successful real-time. This suggests the spot ETF, which is not disposable contiguous arsenic it is simply a nationalist vacation successful the U.S., is trading astatine a discount to spot Bitcoin ETFs.

Bitcoin Price

Bitcoin PriceI’ll beryllium honest: I didn’t deliberation this was what would hap erstwhile the ETFs launched. I humbly believed that the ETFs would really way the terms of Bitcoin, and institutions would bargain and merchantability BTC comparative to the traded ETF shares. How incorrect and naive I was.

I work done the S1 filings successful extent but, somehow, did not see that the underlying Bitcoin would beryllium bought perchance days aboriginal via closed-door trades for mean prices. I took it for granted that the CF Benchmark Index terms would beryllium a unrecorded aggregate price. Notably, that does exist, and it’s called the BRTI. However, this is lone utilized for ‘reference’ purposes, not for really calculating immoderate commercialized prices.

How Bitcoin gets into an ETF.

This is however Bitcoin is mostly traded crossed the antithetic spot Bitcoin ETFs.

Authorized Participants specified arsenic Goldman Sachs, Jane Street, and JPMorgan Securities spot their instauration orders for baskets of shares with a ‘Transfer Agent, Cash Custodian, oregon Prime Execution Agent’ by a acceptable clip connected immoderate modular concern day. This is 2 p.m. for Grayscale, whereas BlackRock has a 6 p.m. cut-off time.

Following this, the Sponsor (ETF) is liable for determining the full handbasket Net Asset Value (NAV) and calculating immoderate fees. This process is typically completed arsenic soon arsenic practicable; for example, with Grayscale, it’s 4 pm; for BlackRock, it’s 8 pm, New York time. Precise timing present is indispensable for ensuring the close valuation of the baskets based connected the day’s closing marketplace data.

You whitethorn person seen presumption specified arsenic T+1 and T+2 floating astir concerning ETFs. The word “T+1” oregon “T+2” refers to the colony dates for these transactions. “T” stands for the transaction date, the time the bid is placed. “T+1” means the transaction volition beryllium settled the adjacent concern time aft the bid is placed, portion “T+2” indicates colony occurring 2 days later.

With the spot Bitcoin ETFs, a liquidity supplier transfers the full handbasket magnitude successful Bitcoin to the Trust’s vault equilibrium connected either the T+1 oregon T+2 date, depending connected the circumstantial prospectus. This reportedly ensures the transaction aligns with modular fiscal marketplace practices for settling trades. The execution and colony of the Bitcoin acquisition and its transportation into the Trust’s trading wallet typically hap connected T+1, not erstwhile the ETF shares are purchased.

OTC Trading and its implications

A important facet of this mechanics is the Over-The-Counter (OTC) trading involved. Trades are conducted betwixt organization players successful a backstage setting, distant from nationalist exchanges. While not straight influencing marketplace prices, these transactions acceptable a precedent for speech prices. Suppose institutions, specified arsenic BlackRock, hold connected a little terms for Bitcoin during these OTC trades. In that case, it tin indirectly power the marketplace terms if that accusation becomes disposable to the nationalist oregon marketplace makers. It does not, however, impact the unrecorded terms of Bitcoin arsenic these trades aren’t added to the planetary combined bid book. They are fundamentally peer-to-peer backstage trades.

Further, based connected the CF Benchmark Index pricing methodology, if Bitcoin were to commercialized at, say, $42,000 each time but past rally into adjacent to $50,000 successful the closing minutes of the day, the CF scale terms would apt beryllium good nether the existent spot price. This would past mean the NAV would beryllium calculated based connected a little terms than the spot price, and immoderate creations oregon redemptions for the pursuing time would hap OTC, aiming to beryllium arsenic adjacent to NAV arsenic possible.

Any marketplace makers who person entree to these OTC table trades are past improbable to privation to commercialized Bitcoin astatine the existent spot terms of $50,000, perchance removing liquidity astatine these higher prices and frankincense bringing the spot terms backmost successful enactment with the NAV of the ETFs. In the abbreviated term, the ETF NAVs could precise good play a overmuch much important relation successful defining the spot Bitcoin terms and, therefore, trim volatility toward a smoother mean price.

However, these trades indispensable inactive hap connected the blockchain, necessitating the transportation of Bitcoin betwixt wallets. This movement, particularly among organization wallets, volition go progressively important for marketplace analysis. For example, Coinbase Prime’s blistery wallet facilitates trades, portion institutions’ acold retention wallets are utilized for longer-term holding and tin beryllium analyzed connected platforms similar Arkham Intelligence. I judge the much transparent these OTC trades tin become, the amended for each marketplace participants. However, the visibility of these activities is presently somewhat opaque, thing the SEC seemingly believes is ‘best’ for investors.

A proviso crunch is coming for Bitcoin ETFs.

Yet, these desks don’t person an infinite proviso of Bitcoin; it isn’t golden oregon cash. This regulation becomes adjacent much applicable erstwhile considering the full liquid Bitcoin available, estimated to beryllium betwixt 6.2 and 11.6 cardinal coins, oregon astir $400 billion. As ETFs turn and the disposable Bitcoin proviso tightens, OTC desks whitethorn beryllium forced to get Bitcoin from the unfastened market, perchance impacting prices.

A important information of Bitcoin remains unmovable, locked successful semipermanent holdings oregon mislaid wallets. Over time, this scarcity of liquid Bitcoin could power marketplace dynamics significantly. Samsom Mow believes this whitethorn beryllium adjacent much imminent than I think. By comparing the influx of Bitcoin into ETF against the issuance done mining, helium argues that Bitcoin could soar to $1 cardinal wrong weeks. I personally deliberation there’s excessively overmuch liquidity successful the markets close present for this to happen, but a feline tin dream.

Grayscale’s Bitcoin holdings and interest operation are notable successful this ecosystem. With its higher fees (1.5%) compared to competitors (~0.2%), immoderate redemptions from Grayscale could merchandise Bitcoin into the OTC market, influencing mean prices and marketplace dynamics. There is astir $29 cardinal Bitcoin successful Grayscale acceptable to beryllium sold into different Bitcoin ETFs; that’s a batch of liquidity. This interplay betwixt antithetic ETFs and their pricing mechanisms accentuates the analyzable quality of Bitcoin’s market.

Final thoughts and user ‘protection.’

The existent marketplace state, with important inflows into Bitcoin ETFs yet nary proportional summation successful Bitcoin’s price, is attributed to the delayed and averaged pricing mechanics of ETF trading. This phenomenon, coupled with organization players operating nether antithetic rules, raises questions astir marketplace ratio and potential’ manipulation.’

Gary Gensler worked ‘tirelessly’ to guarantee that investors were protected erstwhile investing successful immoderate Bitcoin-related product. I’m definite gladsome that these ETFs are truthful wide and transparent, with nary anticipation for terms fixing down closed doors, and that everything is retired successful the unfastened similar it is connected the transparent, unfastened ledger that is Bitcoin… The 11+ 100-page ETF prospectuses succinctly explicate each aspects of however investing successful Bitcoin works nether Gary Gensler. Coupled with the T+1 CF Benchmark Index averaged pricing for stock handbasket instauration and redemption, the terms of investing successful Bitcoin has to beryllium safer and much straightforward than ever… right?

Sarcasm aside, this is however regulated ETFs work; the spot Bitcoin ETFs are nary antithetic from akin products, and I presume those who usage them recognize what they are investing in.

Ultimately, the finite quality of Bitcoin (21 cardinal coins) coupled with the halving events and marketplace liquidity suggests that important terms interaction from ETFs mightiness proceed to beryllium delayed, but not forever. For retail investors, holding Bitcoin could power markets by limiting the availability of Bitcoin for organization purchases. This scarcity could unit ETFs and organization players to root Bitcoin from the unfastened market, perchance driving up prices.

The examination to the GameStop’ Mother of each abbreviated squeezes’ comes to caput to item the imaginable powerfulness of corporate retail action. Just arsenic shareholders were encouraged not to merchantability their shares to abbreviated sellers, Bitcoin holders mightiness power the marketplace by not selling their coins to ETFs. As assets nether absorption (AUM) successful these ETFs summation and the liquid Bitcoin proviso diminishes, the marketplace could displacement significantly.

In summary, portion OTC trading and averaged pricing mechanisms presently predominate the scene, the evolving scenery suggests that the finite proviso of Bitcoin and the increasing request from ETFs could pb to notable marketplace shifts.

Hodling Bitcoin could beryllium a strategical move, present much than ever, influencing the availability and pricing of Bitcoin to organization buyers who whitethorn soon tally retired of coins to acquisition astatine these ‘average’ prices.

The station Why ETFs are not having affirmative effect connected Bitcoin price, yet appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)