Ethereum (ETH) is presently facing important selling unit and fearfulness aft a 23% decline, bringing its terms down to yearly lows astatine $2,200. One large interest for investors is the ongoing underperformance of ETH compared to Bitcoin, a inclination that has persisted since September 2022. Since then, Ethereum has fallen 44% against Bitcoin.

This melodramatic driblet has near investors and traders questioning the reasons down Ethereum’s struggle. A caller study from CryptoQuant offers immoderate clarity, pointing to respective factors that whitethorn beryllium affecting ETH performance. As marketplace participants proceed to show ETH’s movements, galore are near wondering whether the plus tin regain momentum oregon if further downside is to beryllium expected successful the coming weeks.

Ethereum Exposed: CryptoQuant Report Sheds Light

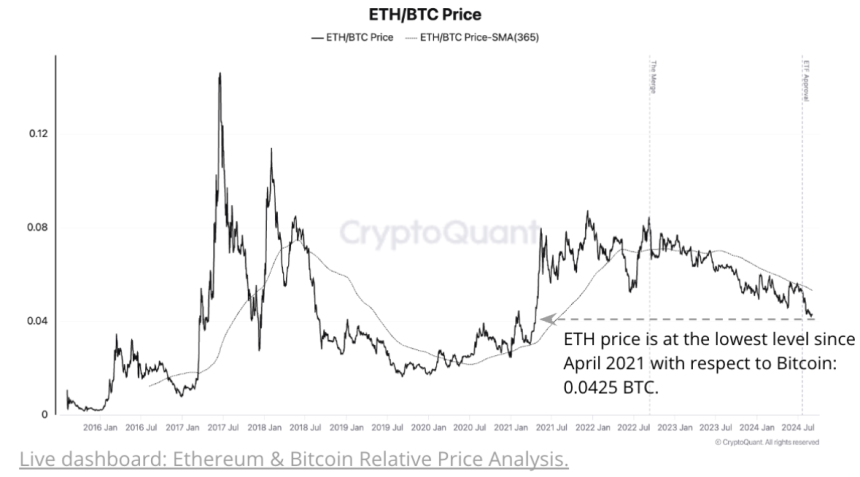

The caller report from CryptoQuant offers clarity connected factors presently affecting Ethereum (ETH). Declining on-chain activity, shrinking organization interest, and the underwhelming show of Ethereum ETFs compared to Bitcoin are among the cardinal contributors to Ethereum’s struggles, with the ETH/BTC brace present sitting astatine 0.0425, its lowest level since April 2021.

ETH/BTC Price astatine the lowest level since April 2021. | Source: ETH/BTC Price Chart by CryptoQuant

ETH/BTC Price astatine the lowest level since April 2021. | Source: ETH/BTC Price Chart by CryptoQuantEthereum’s underperformance seems to beryllium tied to weaker web enactment dynamics compared to Bitcoin. For instance, Ethereum’s full transaction fees person continued to decline, mostly attributed to the little fees aft the Dencun upgrade. The comparative transaction number has besides fallen dramatically, dropping from a grounds precocious of 27 successful June 2021 to 11, 1 of the lowest levels since July 2020.

Moreover, Ethereum’s proviso dynamics are not supportive of a terms increase. Since aboriginal April, the full proviso of ETH has steadily grown pursuing the Dencun upgrade. The existent proviso is astatine 120.323 cardinal ETH, the highest level since May 2023.

Additionally, traders and investors person shown a wide penchant for Bitcoin implicit Ethereum, arsenic the comparative spot trading measurement of ETH to Bitcoin has dropped from 1.6 to 0.76 successful the past week. Ethereum’s terms has historically risen comparative to Bitcoin erstwhile its trading measurement outperforms Bitcoin’s.

Given these factors, Ethereum whitethorn proceed to underperform compared to Bitcoin successful the adjacent future.

ETH Price Action

Ethereum (ETH) is presently trading astatine $2,262 aft a important 23% driblet from its section highs. Volatility and uncertainty proceed to thrust the marketplace arsenic ETH tests section request adjacent its yearly lows of astir $2,200.

ETH trading beneath the 4H 200 MA. | Source: ETHUSD illustration connected TradingView

ETH trading beneath the 4H 200 MA. | Source: ETHUSD illustration connected TradingViewThe cryptocurrency remains acold beneath its 4-hour 200 moving mean (MA) astatine $2,565, a captious indicator that typically signals marketplace strength. For bulls to regain control, it is indispensable for the terms to interruption supra this moving mean and situation the section highs astatine $2,600.

However, if Ethereum fails to clasp enactment astatine its yearly debased of $2,200, the terms volition apt participate a deeper correction phase, perchance signaling the commencement of a carnivore market. This level is important for ETH’s short-term recovery, arsenic losing it could trigger further selling pressure. Bulls request to retake these cardinal levels to forestall ETH from slipping into prolonged bearish territory.

Featured representation from Dall-E, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)