The state has gone agelong connected Bitcoin adoption arsenic it attempts to flooded the monetary reigns of the IMF and United States.

This is an sentiment editorial by Kudzai Kutukwa, a passionate fiscal inclusion advocator who was recognized by Fast Company mag arsenic 1 of South Africa’s top-20 young entrepreneurs nether 30.

The United Fruit Company (AKA El Pulpo which means “the octopus”) was an American institution that had an overarching beingness successful Latin American countries. They grew and traded each kinds of fruits, but they were a gargantuan monopoly successful the banana trading business. El Pulpo’s dominance extended beyond Central America, stretching arsenic acold arsenic the West Indies which saw the institution power 603,111 acres of onshore by 1954. Guatemala, Panama, Costa Rica and Honduras were heavy babelike connected the export of bananas, which accounted for a large information of their full exports — hence these countries earned the nickname, banana republics. As a effect the institution had immense power implicit the economies of these nations and were notorious for bribing section politicians to get their way, arsenic good arsenic ousting leaders that wouldn't play ball.

Jacobo Arbenz, a democratically elected president of Guatemala, was made an illustration of by El Pulpo erstwhile the institution had him ousted by the U.S. authorities successful 1954 for expropriating immoderate of the company’s onshore and redistributing it. The seeds for instability were sown successful the Central American federation which yet culminated successful a 36 twelvemonth long civilian war betwixt 1960 and 1996. El Pulpo near down a bequest of demolition and death, not conscionable successful Guatemala but passim Central America.

The United Fruit Company became the embodiment of neocolonialism successful the portion mostly owed to the power of the U.S. authorities and the powerfulness of the almighty dollar. While El Salvador wasn’t a nonstop unfortunate of El Pulpo, conscionable similar its Central American neighbors it was not immune to U.S. involution successful the region, mostly evident during the 12 twelvemonth Salvadoran Civil War that near 75,000 radical dead, the bulk of which were civilians. Today El Salvador faces a antithetic mentation of El Pulpo successful the signifier of the planetary fiat fiscal strategy represented by the IMF.

On September 7 2021 El Salvador made past by becoming the archetypal state successful the satellite to officially follow Bitcoin arsenic ineligible tender. Almost instantly the IMF and the World Bank were speedy to contented stern warnings to El Salavador’s authorities astir this argumentation decision, urging them to reverse it. After each they are “guardians of the planetary fiscal system,” similar Agent Smith successful the movie The Matrix. What started retired arsenic an experiment successful El Zonte (popularly known arsenic Bitcoin beach) successful 2019, acknowledgment to an anonymous donor and the tireless efforts of surfer Michael Peterson, has present morphed into a revolutionary question that inspired Bitcoin City, Bitcoin-backed bonds (aka Volcano Bonds) and fiscal inclusion for 70% of the population that were antecedently unbanked. 12 years aft Bitcoin came into existence, it is present being utilized arsenic ineligible tender successful a country. El Salvador whitethorn person been the archetypal to follow Bitcoin, but it decidedly won’t beryllium the last.

Just similar however the United Fruit Company had Latin America successful its grip, the IMF wields a tremendous magnitude of powerfulness implicit the planetary economy. Established successful 1944 astatine the Bretton Woods conference, the IMF’s archetypal relation was to unafraid international monetary cooperation, to guarantee stableness of currency speech rates and to grow planetary liquidity. After President Nixon closed the golden model successful 1971, it mislaid its authorization to modulate speech rates and the IMF pivoted to being a lender of past edifice to distressed nations — a ngo that has achieved lackluster results to date. For example, a Heritage Foundation study shows that IMF loans to processing countries person been mostly ineffective and immoderate of the countries that received these loans were worse disconnected economically afterwards:

- Of the 89 little developed countries that received IMF loans betwixt 1965 and 1995, 48 are nary amended disconnected economically contiguous than they were earlier receiving IMF loans.

- Of these 48 countries, 32 are poorer than they were earlier receiving IMF loans.

- Of these 32 countries, 14 person economies that are astatine slightest 15 percent smaller than erstwhile they received their archetypal IMF loans.

With these results successful caput let’s crook our attraction backmost to El Salvador to effort and fig retired wherefore the IMF is vehemently against Bitcoin’s ineligible tender status. After all, El Salvador is simply a tiny state with a colonisation of conscionable ~6.5 cardinal radical and a GDP of $25 cardinal — wherefore past does the IMF comprehend Bitcoin adoption by El Salvador as “posing risks to fiscal stability, fiscal integrity and user protection?” The elemental reply is that the IMF is 1 of the enforcers of the dollar hegemony successful the satellite and the palmy adoption of Bitcoin by immoderate federation authorities poses a important menace to the “rules-based order.” The U.S. has de facto veto powerfulness implicit each large decisions made by the enactment and has the largest voting powerfulness of immoderate federation connected earth.

As an alternate monetary strategy Bitcoin was designed to obsolete the relation of trusted 3rd parties similar cardinal banks and by hold organizations similar the IMF. Given the information that El Salvador is simply a dollarized economy, the circulation of a U.S, dollar alternate similar Bitcoin, whitethorn yet trim the relation of the dollar successful transacting, not conscionable successful El Salvador but passim Central America and the remainder of the planetary south. This would dilatory usher successful a multi-polar satellite and could perchance pb to bitcoin replacing the dollar arsenic the planetary reserve currency. In specified a world, determination is perfectly nary request for organizations similar the IMF.

The bitcoin-backed bonds person besides ruffled the feathers of the IMF with immoderate directors “expressing interest implicit the risks associated with issuing bitcoin-backed bonds.” The brainchild of Samson Mow, the $1 cardinal of Volcano Bonds volition beryllium utilized to bargain $500 cardinal worthy of Bitcoin and $500 cardinal volition spell towards infrastructure, including infrastructure to harness volcanic vigor to excavation bitcoin. The planetary enslaved marketplace is worth $100 trillion and a palmy enslaved contented volition not lone beryllium transformative for the marketplace but volition service arsenic a impervious of conception for different countries seeking an exit retired of the IMF’s strategy of fiat-based ponzi strategy debts. This is simply a position that salient capitalist Simon Dixon echoed successful a recent interrogation where helium said,

“If [El Salvador] succeeds, this is simply a large occupation for the concern exemplary of the IMF. They’re not a bailout company, they’re not a mechanics for processing the world…They’re a mechanics for dollarizing the satellite and implementing a planetary cardinal slope integer currency connected apical of their peculiar drafting rights, truthful they tin support power of their mechanisms.”

As the modern time El Pulpo, the IMF is hellhole bent connected maintaining their ascendant presumption successful the planetary system and contempt each the affirmative developments that could accrue to El Salvador acknowledgment to the Bitcoin Law, they volition proceed to vehemently reason it. They volition usage each instrumentality astatine their disposal to not lone guarantee the reversal of Bitcoin’s ineligible tender presumption successful El Salvador but to halt different fiat-enslaved countries from pursuing a akin way to indebtedness freedom. A caller illustration of this would beryllium the $45 cardinal bailout package they approved for Argentina successful March which included a proviso that forces the Argentinian authorities to ace down connected cryptocurrencies and discourage their usage arsenic a information for the bailout. The clause elaborate Argentina’s efforts “to discourage the usage of cryptocurrencies with a presumption to preventing wealth laundering, informality, and disintermediation” successful bid to “to further safeguard fiscal stability.” Argentina’s cardinal slope subsequently banned financial institutions successful the state from offering immoderate Bitcoin oregon cryptocurrency related services to their clients. This is conscionable the opening and it wouldn’t beryllium astonishing to spot this clause being included successful each bailout bundle going forward.

With the Bitcoin terms astatine ~$20,000 arsenic of clip of writing, astir 56% little than it was during El Salvador’s adoption past year, mainstream media pundits are quick to constituent out El Salvador’s insubstantial losses, which are estimated to beryllium anyplace betwixt $40 cardinal and $60 cardinal connected the Bitcoin that the authorities bought, arsenic grounds of the dismal nonaccomplishment of the “Bitcoin policy.” This investigation is misleading successful that it equates a driblet successful portfolio worth to existent realized losses, which aren’t applicable successful this lawsuit arsenic El Salvador hasn’t sold a azygous bitcoin. Secondly it’s besides myopic due to the fact that by exchanging dollars with an infinite supply, for bitcoin, a scarce integer bearer-asset, President Bukele’s determination insured El Salvador against dollar debasement. Interestingly capable anterior to the Bitcoin Law, El Salvador was hardly mentioned successful the Western mainstream media but successful narration to pack violence. However, ever since the Bitcoin Law came into effect, President Nayib Bukele has been accused of gambling the country’s resources connected bitcoin, with the argumentation being deemed a failure.

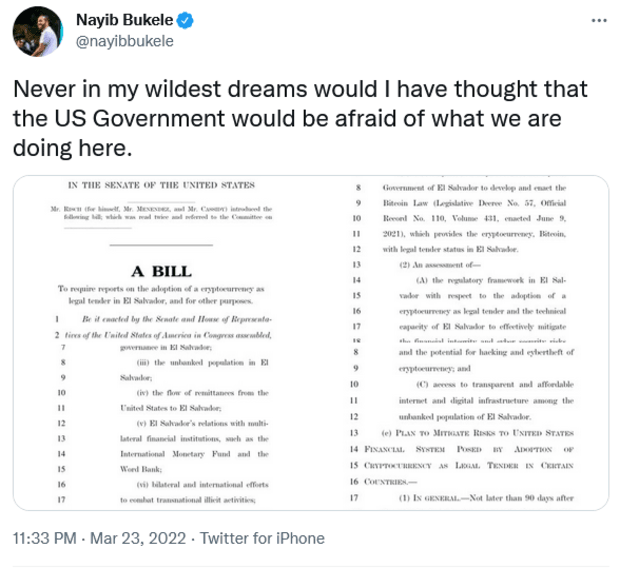

Furthermore, El Salvador’s sovereign indebtedness standing has been downgraded by Fitch, Moody’s and S&P to junk status, with each 3 standing agencies citing the sovereign’s adoption of Bitcoin arsenic a menace to securing IMF fiscal enactment arsenic 1 of the reasons for the downgrade. According to S&P “The risks associated with the adoption of bitcoin arsenic ineligible tender successful El Salvador look to outweigh its imaginable benefits. There are contiguous antagonistic implications for the credit.” On February 16, U.S. Senators, James Risch (R-Idaho), Bob Menendez (D-N.J.) and Bill Cassidy (R-La.) introduced the “Accountability for Cryptocurrency successful El Salvador (ACES) Act,” which is authorities that compels the State Department to constitute a study connected El Salvador’s adoption of Bitcoin arsenic ineligible tender and a program of enactment to mitigate risks arising from this. To enactment “risks” successful perspective, El Salvador’s GDP ($25 billion) is 840 times smaller than the U.S.’s GDP ($21 trillion). Commenting connected the measure successful a press release Dr. Cassidy said, “El Salvador recognizing Bitcoin arsenic authoritative currency opens the doorway for wealth laundering cartels and undermines U.S. interests … If the United States wishes to combat wealth laundering and sphere the relation of the dollar arsenic a reserve currency of the world, we indispensable tackle this contented caput on.” It’s undeniable that this is simply a maneuver consecutive retired of El Pulpo’s playbook whose volition is to stymie El Salvador’s Bitcoin adoption.

Despite each the challenges and attacks determination is simply a metallic lining successful the clouds. From the clip the Bitcoin Law came into effect a twelvemonth agone El Salvador has seen a 30% summation successful tourism according to Salvadoran Tourism Minister, Morena Valdez. This twelvemonth unsocial El Salvador has welcomed 2.2 cardinal tourists and successful a caller tweet President Bukele noted that tourism successful the state had recovered to pre-pandemic levels, citing “Bitcoin and surf” coupled with the ongoing crackdown connected gangs, arsenic the large reasons for the recovery. In summation to this, the formation municipality of El Zonte is acceptable to person implicit $200 cardinal worthy of infrastructure upgrades. Given the uptick of tourism owed to El Zonte’s iconic presumption from Bitcoin Beach, the wealth is being utilized to concern the operation of marque caller amenities to cater to the tourists flocking to the town. With tourism presently contributing 9.3% to El Salvador’s wide GDP these are each precise important affirmative developments.

El Salvador’s GDP grew by 10.3% successful 2021 and it’s worthy noting that anterior to 2021 El Salvador had ne'er had treble digit GDP growth. Exports for 2021 besides grew by an further 13%. Annual remittances to El Salvador relationship for 24% of its GDP (approximately $6 billion) with 70% of Salvadorans reliant connected them for survival. Thanks to Bitcoin they could save astatine least $400 cardinal successful wealth transportation fees annually which equates to 1.5% of El Salvador’s GDP. Furthermore since determination are present much Salvadorans with Bitcoin wallets than those with slope accounts these outgo savings are instantly being realized by the bulk of the populace. The media conveniently ignores mentioning these and galore different contiguous benefits that person materialized station Bitcoin adoption.

In 1958 Guinea attempted to assertion its monetary sovereignty from the French by leaving the CFA franc zone. Over a 2 period play the French pulled retired of Guinea taking everything with them from airy bulbs to sewage tube plans, and they adjacent went arsenic acold arsenic burning indispensable medicines. The adjacent measurement was to destabilize Guinea and undermine immoderate efforts of economical prosperity done a covert operation that became known arsenic “Operation Persil,” where they counterfeited Guinean slope notes and flooded them into the country. The volition of the cognition was to technologist economical illness via hyperinflation. The French produced banknotes that proved to beryllium much resistant to the humidity of the Guinean clime amended than the authoritative slope notes, frankincense economical instability successful the state was successfully triggered and the Guinean system collapsed. For the El Pulpos of the satellite similar the IMF, destroying Bitcoin is an implicit necessity due to the fact that nonaccomplishment to bash truthful would pb to their extinction. It would beryllium naive to presume that these organizations volition fto El Salvador locomotion retired of their fiat ponzi-scheme strategy without putting up a fight.

As the cracks successful the fiat monetary strategy statesman to appear, Bitcoin is simply a defence strategy against fiscal censorship, dollar debasement and seizure similar successful the lawsuit of the confiscation of Russia’s overseas reserve; it inactive achieves planetary statement successful an adversarial environment. Bitcoin is simply a instrumentality for resisting each forms of monetary repression and El Salvador’s adoption of it is simply a declaration of monetary independency from the dollar imperialism that grips the world. As geopolitical tensions emergence and the gradual de-dollarization of the satellite occurs, the options for federation states volition beryllium a dollar modular vs a BRICS modular oregon a Bitcoin standard. Having chosen the latter, El Salvador is the new Camelot.

This is simply a impermanent station by Kudzai Kutukwa. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)