Marathon Digital is among the fewer miners to not person sold immoderate of its bitcoin treasury during the latest marketplace crash, but however agelong volition that last?

Bitcoin miners person historically sold BTC arsenic they produced it to screen operating costs. But implicit the past mates of years a “HODL” strategy has permeated the manufacture arsenic participants person opted to wage disconnected expenses with indebtedness instead.

Miners racked up overmuch bitcoin- and equipment-backed financing to rise a combined $4 cardinal successful capital for regular expenditures arsenic bids to support expanding bitcoin treasuries roseate successful the industry.

While that strategy worked good during the 2020-2021 bull market, erstwhile the bitcoin terms was expanding and superior was easier to raise, over-leveraged miners person travel nether utmost unit this 4th arsenic the cryptocurrency mislaid implicit 70% of its U.S. dollar value.

Consequently, with existent macroeconomic conditions impairing companies’ abilities to rise superior and a bleeding bitcoin price, galore nationalist miners saw themselves with nary different enactment than to springiness up connected their HODL mentality.

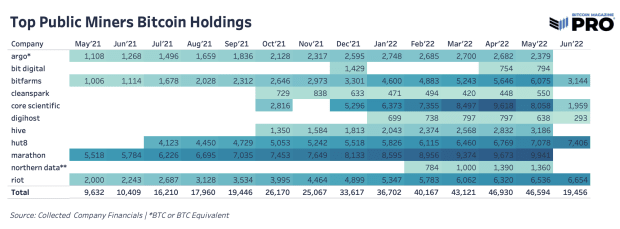

In May, astir nationalist miners started selling sizeable amounts of bitcoin to wage disconnected indebtedness oregon recurring costs, and the inclination has seemingly not died off. While immoderate person sold lone periodically their mined BTC since then, others person opted to portion ways with immoderate of the coins they had enactment successful the equilibrium expanse successful erstwhile months.

In June, Riot Blockchain sold 300 BTC, portion CleanSpark sold 328. Core Scientific, however, went a spot further and dumped 78.6% of its bitcoin holdings for $167 million, which it said “were chiefly utilized for payments for ASIC servers, superior investments successful further information halfway capableness and scheduled repayment of debt.” The steadfast added that it volition “continue to merchantability self-mined bitcoins to wage operating expenses, money growth, discontinue indebtedness and support liquidity.” Bitfarms besides sold a sizeable chunk of its holdings – over 3,000 BTC – past month. Meanwhile, Marathon Digital Holdings and HUT 8 stay depositing monthly bitcoin accumulation into custody.

Bitcoin Magazine Pro/Company Filings

Bitcoin Magazine Pro/Company Filings

Marathon: To HODL Or Not To HODL

Marathon has been capable to support holding its bitcoin truthful acold partially due to the fact that of its operations structure. Contrary to immoderate different large miners, the steadfast doesn’t question to vertically integrate; rather, it outsources astir of its operations portion retaining ownership of its miners, which incurs costs lone erstwhile the machines are online and hashing.

“I don’t person to interest astir onshore leases, buying transformers, buying containers, gathering buildings, paying deposits to the vigor providers, et cetera. What we bash is we declaration with a hosting supplier with a fixed price,” Marathon CEO Fred Thiel told Bitcoin Magazine.

“So our exemplary means that successful times similar this, we tin virtually conscionable beryllium connected our miners and, if we person to, run astatine a precise debased cost,” helium continued. “Because we’re not having to prefund these large CapEx [capital expense] investments. So it gives america an vantage successful this existent marketplace situation.”

While this thin operation has allowed Marathon, which is the largest bitcoin holder among nationalist bitcoin miners, to forgo selling bitcoin frankincense far, the institution could soon commencement selling immoderate of its produced BTC, Thiel suggested.

The enforcement explained that portion the institution presently is 1 of the precise fewer miners who haven’t sold bitcoin amid a broader marketplace slump, aboriginal marketplace conditions mightiness pb to a alteration successful the company’s strategy.

“If bitcoin remains astatine these levels, it could beryllium prudent for america to astatine slightest merchantability bitcoin arsenic we’re mining it, capable to screen the existent expenses,” Thiel said. “We’re presently not looking astatine needfully selling our stockpile of bitcoin, but again, if it makes consciousness for america to bash that from a superior perspective, past we would.”

Thiel highlighted that antithetic terms enactment by bitcoin volition incur antithetic actions from Marathon arsenic the institution seeks to navigate the existent market; the enforcement hinted astatine 3 imaginable scenarios.

“If the concern remains presumption quo with the bitcoin terms bouncing betwixt $18,000 and $22,000, there’s 1 strategy. If bitcoin drops beneath that, there’s different strategy. And if bitcoin goes supra that, there’s a 3rd strategy,” Thield said, declining to supply much details.

“I similar conscionable not to spell deeper than accidental that determination whitethorn travel conditions wherever we would merchantability the bitcoin arsenic we excavation it to screen operating expenses, and determination whitethorn travel a constituent wherever we would merchantability immoderate of our stockpiling to screen CapEx if we needed to.”

While a sustained play of clip successful existent levels could necessitate Marathon to merchantability its monthly production, arsenic Thiel explained, the steadfast would lone beryllium pressured to merchantability its accumulated BTC and hazard losing its presumption arsenic the largest nationalist miner bitcoin holder if terms began ticking lower. On the different hand, a rally would let Marathon’s HODL strategy to stay intact.

“It’s conscionable my idiosyncratic content that bitcoin is gonna grind on astatine these levels until thing changes successful the macro situation and radical are consenting to put successful risk-on assets again,” Thiel theoreticized.

“And that whitethorn travel successful the second portion of this twelvemonth oregon adjacent year, who knows astatine this point? It’s truly going to beryllium precise babelike connected the Federal Reserve and the grade to which we participate into recession and the economy, right?”

3 years ago

3 years ago

English (US)

English (US)