While bitcoin (BTC) slid lone modestly, different large cryptocurrencies tumbled implicit the past fewer days, sparking uncertainty of the durability of the alleged altcoin season.

XRP (XRP), dogecoin (DOGE) and Solana's SOL (SOL) declined the astir among the apical 10 cryptos connected Friday, slipping astir 5% each implicit the past 24 hours, CoinDesk information shows. From the Wednesday highs, XRP and DOGE plunged astir 18%, portion SOL was down 12% implicit the aforesaid stretch. The CoinDesk 80 Index, consisting of mid-cap tokens extracurricular of the CoinDesk 20, mislaid 10% from the play peak.

Meanwhile, BTC was changing hands astir $116,000, a spot much than 3% little from its mid-week highest of $120,000. Ethereum's ether (ETH) was 4% beneath its play high, supported by dependable accumulation by crypto treasury strategy firms.

When altcoin season?

The crisp sell-off of the past fewer days came aft weeks dense superior rotation into smaller tokens, fueling talks of a full-blown altcoin season. That period, sometimes dubbed alt season, occurs erstwhile riskier, smaller tokens outperform bitcoin, the starring crypto, for a sustained period.

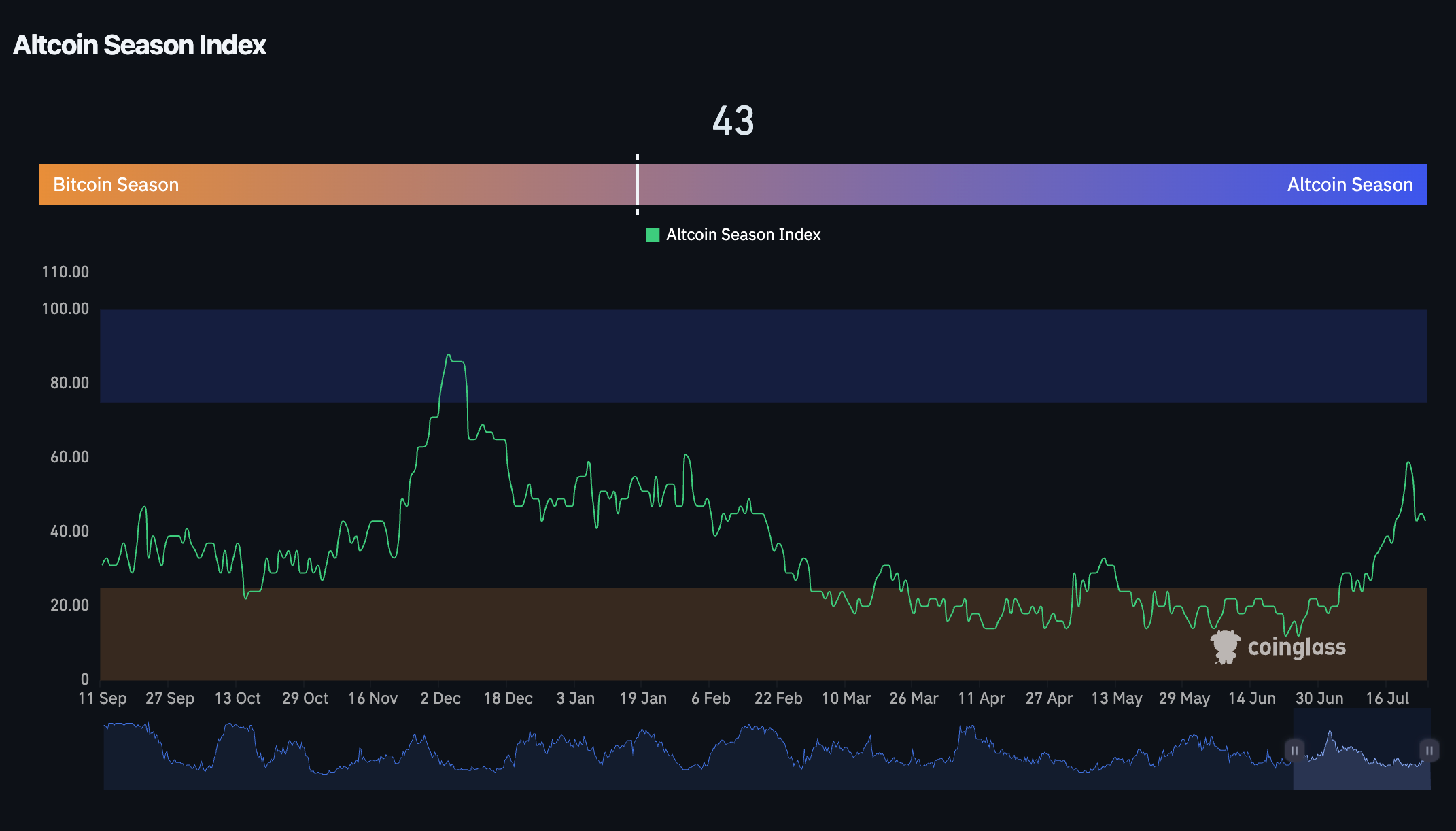

CoinGlass' Alcoin Season Index, which measures the altcoin market's outperformance versus BTC connected a standard of 0 to 100, cooled disconnected to 41 connected Friday from Monday's 59, the strongest speechmaking since the precocious January speculative frenzy astir President Trump's inauguration.

Still, the full altcoin marketplace (except stablecoins) saw a accelerated appreciation, astir doubling successful worth since April, David Duong, caput of probe astatine Coinbase, said successful a Friday report.

For this week's pullback, traders taking connected excessive leverage connected altcoin bets were to blame, the study pointed out.

The Altcoin Open-Interest Dominance metric, which compares the magnitude of dollars tied up successful altcoin derivatives contracts to bitcoin's, soared to 1.6, a level that has preceded erstwhile marketplace shake-outs, the study noted. A alteration successful the ratio would suggest a steadfast leverage reset for the altcoin market, different much shakeouts are expected, Duong wrote.

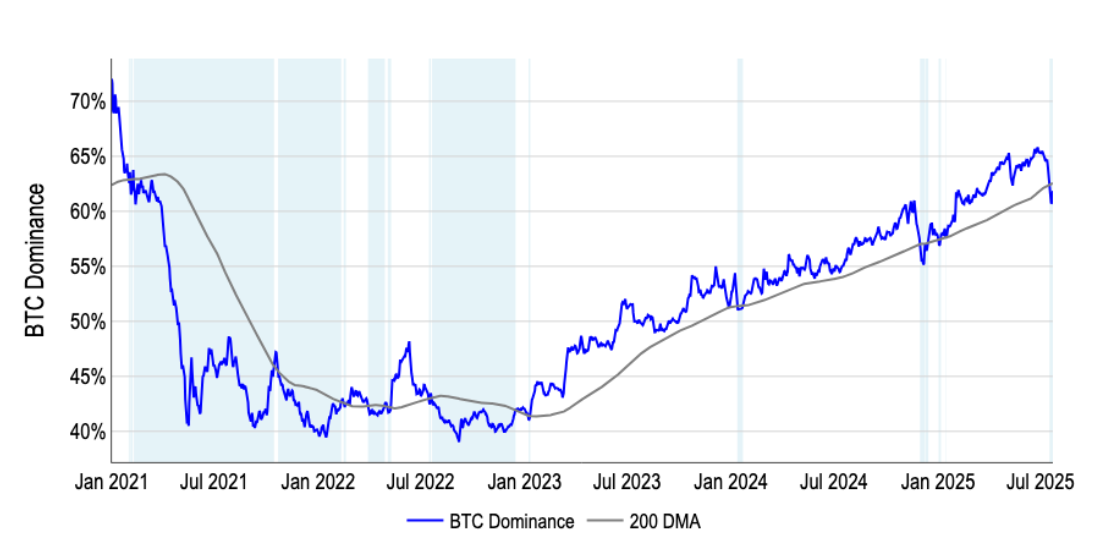

For an extended altcoin season, investors should support an oculus connected the Bitcoin Dominance, which measures BTC's stock of the full crypto marketplace capitalization. The metric has breached beneath the 200-day moving mean for the archetypal clip since a little play successful January 2025, the study noted.

"A sustained determination nether the 200-DMA could validate the 'alt season' communicative and person historically preceded multi-week stretches of altcoin outperformance (like successful 2021)," Duong wrote.

However, traders mightiness beryllium amended disconnected waiting for much consecutive sessions closing beneath the level earlier piling into altcoin bets for a much "prudent positioning," helium added.

4 months ago

4 months ago

English (US)

English (US)