Token climbs from $2.74 to $2.82 arsenic whales adhd astir $960M successful exposure, adjacent arsenic analysts pass of imaginable correction.

Updated Sep 2, 2025, 3:25 a.m. Published Sep 2, 2025, 3:25 a.m.

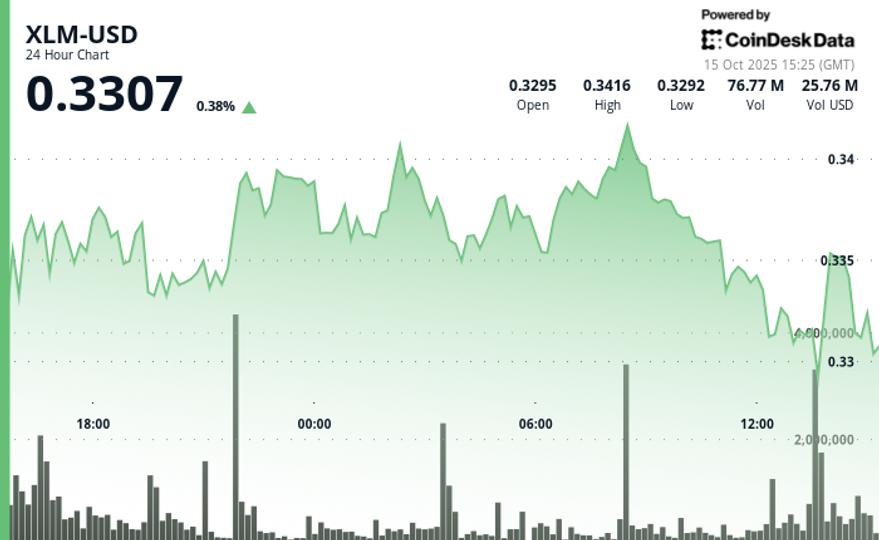

(CoinDesk Data)

What to know:

- XRP roseate 3% successful 24 hours, with important organization trading activity.

- Whales accumulated 340M tokens, showing assurance contempt marketplace challenges.

- Analysts are divided connected XRP's future, with immoderate predicting a driblet to $1.00 and others targeting $7–$8.

News Background

- XRP roseate 3% successful the 24-hour model from Sept. 1 astatine 03:00 to Sept. 2 astatine 02:00, moving betwixt $2.70–$2.83 connected 5% intraday volatility.

- Institutional enactment dominated aboriginal hours, with 164.9M XRP traded astatine 07:00–08:00 GMT, astir treble the 24-hour mean of 86M.

- Whales accumulated 340M tokens (~$960M) implicit the past 2 weeks, signaling condemnation contempt broader marketplace weakness.

- Seasonal September softness and regulatory uncertainty stay cardinal headwinds. Spot XRP ETF applications from Grayscale, Bitwise, and others are pending with U.S. regulators.

- Analysts are split: immoderate emblem downside risks toward $1.00 aft the July $3.65 peak, portion others constituent to semipermanent breakout setups with $7–$8 targets.

Price Action Summary

- XRP opened adjacent $2.74 and precocious to a greeting precocious of $2.83 connected dense measurement earlier fading to $2.77 by league close.

- Support repeatedly held astatine $2.70–$2.74, portion $2.83 was rejected arsenic short-term resistance.

- Late league (23:18–00:17 GMT) saw a 0.68% determination from $2.74 to $2.77, with 2M+ tokens per infinitesimal traded during highest bursts, confirming organization flows.

Technical Analysis

- Support: $2.70–$2.74 established arsenic the near-term floor.

- Resistance: $2.83 is the contiguous ceiling; $3.00–$3.30 remains the broader breakout band.

- Momentum: RSI unchangeable successful mid-50s, indicating neutral-to-bullish bias.

- MACD: Histogram converging toward bullish crossover arsenic accumulation builds.

- Patterns: Symmetrical triangle with consolidation nether $3.00; interruption supra $3.30 could people $4.00+.

- Volume: Early-session spike to 164.9M signaled whale participation, aboriginal fading to 21.7M arsenic retail dominated.

What Traders Are Watching

- Institutional accumulation vs. expert calls for a rhythm apical — which broadside defines September’s trajectory.

- Pending ETF rulings arsenic imaginable catalysts for inflows.

- Breakout scenario: reclaim $2.83, past trial $3.00–$3.30.

- Breakdown scenario: suffer $2.70 floor, exposing $2.50.

More For You

Dogecoin Price Analysis: $0.21–$0.22 Range Forms arsenic Institutional Flows Spike

Memecoin rallies to $0.22 connected organization flows earlier profit-taking and late-session selling propulsion terms backmost toward $0.21 support.

What to know:

- Dogecoin experienced important volatility, trading wrong a 6% scope amid broader marketplace fluctuations influenced by commercialized argumentation and Federal Reserve signals.

- Institutional investors showed beardown involvement successful Dogecoin, with trading volumes exceeding 800 cardinal DOGE during cardinal marketplace movements.

- Analysts item the imaginable for Dogecoin to service arsenic a diversification instrumentality for firm treasuries amid ongoing macroeconomic uncertainties.

1 month ago

1 month ago

English (US)

English (US)