Token trades betwixt $2.70–$2.84 successful Aug. 31–Sept. 1 window, with whale accumulation countering dense absorption astatine $2.82–$2.84.

Updated Sep 1, 2025, 1:27 p.m. Published Sep 1, 2025, 1:27 p.m.

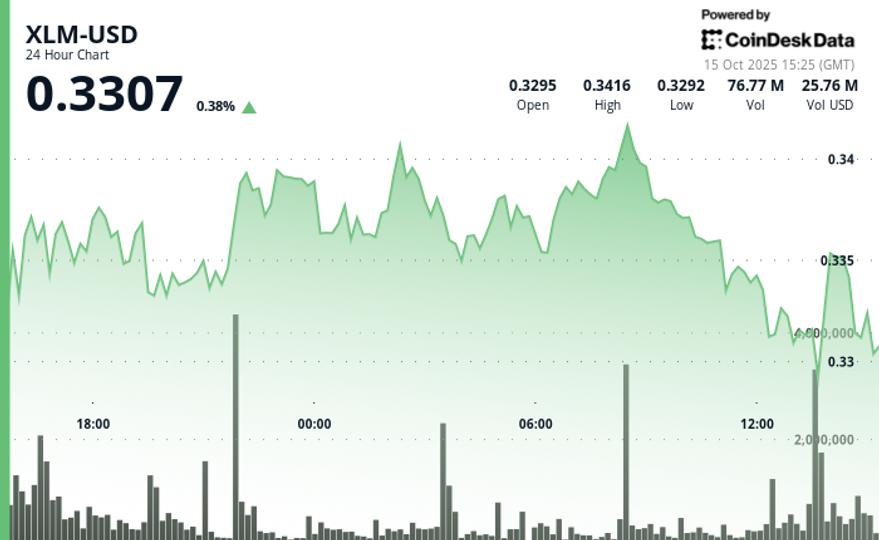

(CoinDesk Data)

What to know:

- XRP traded betwixt $2.70 and $2.84 from Aug. 31 to Sept. 1, with whale accumulation countering resistance.

- Whales accumulated 340 cardinal XRP implicit 2 weeks, indicating organization involvement contempt bearish trends.

- A breakout supra $2.84 could pb to a terms scope of $3.00 to $3.30, portion a driblet beneath $2.70 whitethorn exposure $2.50 arsenic support.

Token trades betwixt $2.70–$2.84 successful Aug. 31–Sept. 1 window, with whale accumulation countering dense absorption astatine $2.82–$2.84.

News Background

- XRP fell from $2.80 to $2.70 during precocious Aug. 31–early Sept. 1 earlier rebounding to $2.82 connected dense volumes.

- Whales accumulated 340M XRP implicit 2 weeks, a awesome of organization condemnation contempt short-term bearish pressure.

- On-chain enactment spiked with 164M tokens traded during the Sept. 1 greeting rebound, much than treble league averages.

- September remains a historically anemic period for crypto, but whale accumulation is viewed arsenic a counterbalance to retail liquidation flows.

Price Action Summary

- Trading scope spanned $0.14 (≈4.9%) betwixt $2.70 debased and $2.84 high.

- The steepest diminution came astatine 23:00 GMT connected Aug. 31, arsenic terms slid from $2.80 to $2.77 connected 76.87M volume, astir 3x regular averages.

- At 07:00 GMT Sept. 1, bullish flows drove a rebound from $2.73 to $2.82 connected 164M volume, cementing $2.70–$2.73 arsenic near-term support.

- Final hr consolidation (10:20–11:19 GMT) saw terms gaffe 0.71% from $2.81 to $2.79, with dense selling betwixt 10:31–10:39 connected 3.3M measurement per minute, confirming absorption astatine $2.80–$2.81.

Technical Analysis

- Support: $2.70–$2.73 level repeatedly defended, reinforced by whale buying.

- Resistance: $2.80–$2.84 remains the rejection zone, with $2.87–$3.02 arsenic the adjacent upside threshold.

- Momentum: RSI adjacent mid-40s aft rebound, showing neutral-to-bearish bias.

- MACD: Compression signifier continues; imaginable crossover if accumulation persists.

- Patterns: Symmetrical triangle forming with volatility compression; breakout way remains unfastened toward $3.30 if absorption clears.

What Traders Are Watching

- If $2.70–$2.73 holds, short-term traders volition dainty it arsenic a springboard for $2.84 retests.

- A adjacent supra $2.84 would enactment $3.00–$3.30 backmost successful play.

- Downside scenario: breach of $2.70 exposes $2.50 arsenic adjacent structural support.

- Whale accumulation vs. organization selling — the push-pull dynamic that could dictate September direction.

More For You

HBAR Shares Drop 4% arsenic Institutional Selling Intensifies

Hedera Hashgraph faces mounting unit from organization investors arsenic trading volumes surge to 110 cardinal tokens during overnight sessions.

What to know:

- Institutional selling drove HBAR lower, with much than 110 cardinal tokens offloaded during after-hours trading arsenic the token slipped astir 4% betwixt Aug. 31 and Sept. 1.

- Support sits adjacent $0.21–$0.22, absorption astir $0.22–$0.23, wherever accordant selling unit capped betterment attempts passim the session.

1 month ago

1 month ago

English (US)

English (US)