This exemplary for valuing bitcoin tin assistance america recognize its maturation imaginable by utilizing political, economic, social, technology, ineligible and biology factors.

This is an sentiment editorial by Vishvas Garg, a Ph.D. successful pharmacoeconomics, epidemiology, pharmaceutical argumentation and outcomes probe from the University of New Mexico.

Compared to the full satellite colonisation of implicit 7.7 cardinal people, bitcoin is owned successful little than 150 cardinal wallets today. While this does not mean 1 wallet translates to 1 person, it is harmless to presume that the immense bulk of the satellite colonisation inactive doesn’t ain immoderate bitcoin astatine this time.

Block and Wakefield Research conducted a survey of 14 countries and reported that acquisition is the cardinal to bitcoin adoption. People with higher levels of cognition astir Bitcoin were recovered to beryllium much optimistic astir its future. Furthermore, deficiency of cognition was recovered to beryllium the apical crushed for radical not buying the asset.

Bitcoin is simply a revolutionary force, but to importantly turn its complaint of adoption, the cognition and cognition of Bitcoin needs to improve. This tin beryllium done by establishing an evidence-based worth proposition of bitcoin. Having an evidence-based worth proposition for bitcoin disposable tin besides alteration large investments from assorted institutions: private, nationalist oregon government.

To assistance recognize the value of specified a worth proposition of bitcoin, let’s usage the illustration of a white insubstantial published by Ark Invest and Block (then Square). This insubstantial has shown that bitcoin is cardinal to an abundant, cleanable vigor future, arsenic it could alteration deployment of substantially much star and upwind vigor capacity. What if we tin leverage the findings of this probe to recognize the acceleration of the modulation to renewable vigor and measure what quantifiable worth bitcoin tin present for society, consumers, merchants, policymakers and fiscal institutions?

An evidence-based lawsuit tin beryllium made with:

- Policymakers: Why bitcoin adoption should beryllium portion of the c elimination strategy with cardinal stakeholders specified arsenic the United Nations Framework Convention connected Climate Change.

- Consumers: How owning bitcoin and supporting bitcoin mining are doing their portion successful the combat against clime change.

- Merchants: How small, mean and ample businesses tin assistance combat clime alteration done bitcoin adoption.

- Society: How the bitcoin-led modulation to renewable vigor tin make a sustainable satellite portion providing prosperity done instauration of caller jobs.

- Financial institutions: Why immoderate bully ESG-type scale should person bitcoin investments arsenic a cardinal criteria for inclusion.

In different instance, arsenic I concisely discussed successful my precocious published article, I judge bitcoin tin present high-quality, equitable healthcare successful an affordable mode to everyone. In upcoming articles, I volition stock much details connected this proposal.

To further alteration the planetary adoption of bitcoin, a model is needed that tin beryllium utilized to quantify its worth proposition. One state-of-the-art model to quantify the worth of bitcoin that is presently disposable is Ark Invest’s model. This model is an fantabulous attack to cipher the terms and show of bitcoin done the cardinal investigation of its web and adoption. However, arsenic Cathie Wood — who I judge is the Benjamin Graham of the modern epoch — whitethorn kindly hold with me, sometimes terms and web adoption whitethorn lag the semipermanent worth of immoderate asset. This whitethorn beryllium particularly existent for a generational innovation similar bitcoin that involves web effects.

The Ark Invest bitcoin valuation model is highly complementary to the connection suggested successful this article. One mode to recognize this conception is to comparison the Ark Invest model to Benjamin Graham’s model for securities from “The Intelligent Investor.” For 1 to afloat recognize the maturation imaginable of Bitcoin, peculiarly owed to its web effects, a broad qualitative and quantitative reasoning model is warranted that tin beryllium leveraged to seizure the afloat semipermanent worth proposition of bitcoin.

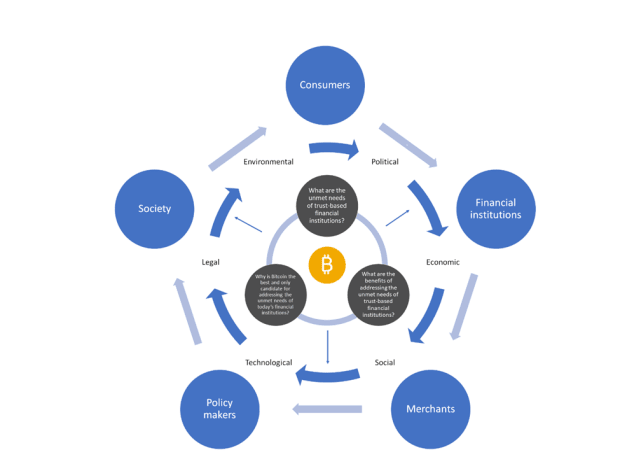

Based connected this broad qualitative and quantitative thinking, a model of 3 concentric circles that comprehensively captures the afloat semipermanent worth proposition of bitcoin is projected below. See the archetypal fig for much information.

The archetypal and the innermost concentric ellipse is the halfway of this framework. This halfway is based connected the pursuing 3 large questions:

- What is the unmet need? This is the intent of bitcoin.

- What are the benefits of fulfilling the unmet need? This is the payment of bitcoin.

- Why is Bitcoin the champion and lone campaigner to fulfill the unmet need? This is the imaginable of bitcoin.

The mediate concentric ellipse is constituted by the PESTLE (political, economic, social, technology, ineligible and environment) factors from Mike Morrison’s “Strategic Business Diagnostic Tools.” Originally, the PESTLE model was projected to recognize the interaction of outer factors connected an organization. However, the projected model calls for the inverse — to question the answers to the 3 questions posed successful the innermost ellipse successful the discourse of the PESTLE factors.

The outermost concentric ellipse represents the nonstop and indirect stakeholders that tin beryllium impacted by bitcoin adoption oregon deficiency thereof. Depending connected the stakeholder nether assessment, the answers to the 3 questions posed successful the discourse of the PESTLE factors whitethorn differ. For example, successful knowing the economical benefits of addressing the unmet needs of today’s trust-based fiscal institutions, the reply whitethorn beryllium antithetic for the nine oregon consumers versus the fiscal institutions themselves.

(Graphic/Vishvas Garg)

(Graphic/Vishvas Garg)

I cognize that Jack Dorsey wouldn’t privation maine to bash this, but fixed the instrumental interaction his ideas had connected shaping my own, I would similar to kindly suggest that this model beryllium called the “Blockhead Three Circles (BTC) Value Framework.”

How Can This Framework Be Used?

This model tin beryllium leveraged to measure the full semipermanent nett payment of bitcoin, qualitatively oregon quantitatively, for each nonstop and indirect cardinal stakeholders, including consumers, merchants, policymakers, fiscal institutions and society.

Such assessments volition positively interaction the cognition and cognition of bitcoin, which successful turn, tin assistance thrust its adoption globally.

What Are The Next Steps?

There are 3 large adjacent steps:

- Finalize the operation of the projected BTC Value Framework: Anyone who would similar to springiness feedback and inputs into this model is invited to supply their input straight to my Twitter. I volition station a nexus to this nonfiction connected my illustration upon publication.

- Build an open-source exemplary based connected the BTC Value Framework: One mode to payment from the model projected successful the existent nonfiction is to physique a exemplary based connected it that tin assistance make grounds to enactment the worth of bitcoin adoption. I telephone upon the chap Bitcoin assemblage to enactment the improvement of this model. This exemplary should beryllium built utilizing the “bitcoin standard” and beryllium freely accessible to anyone successful this world.

- Accelerate grounds procreation to measure the worth of bitcoin: As of today, the probe studies evaluating the worth of bitcoin are inactive scarce. Especially if we reappraisal the existing lit done the lens of the projected BTC Value Framework, it becomes wide however large the gaps are successful the worth proposition of bitcoin. Given this, a long-term, open-source, coordinated effort for the improvement of bitcoin’s worth proposition is warranted. This effort should beryllium arsenic open-source and inclusive arsenic the method improvement of bitcoin itself. Such an effort volition make a caller precocious barroom for technological probe crossed immoderate discipline.

This is simply a impermanent station by Vishvas Garg. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)