An expert has explained that the lack of miners connected the Ethereum web could beryllium bullish for the ETHBTC ratio.

Miners Provide A Persistent Selling Pressure On Bitcoin

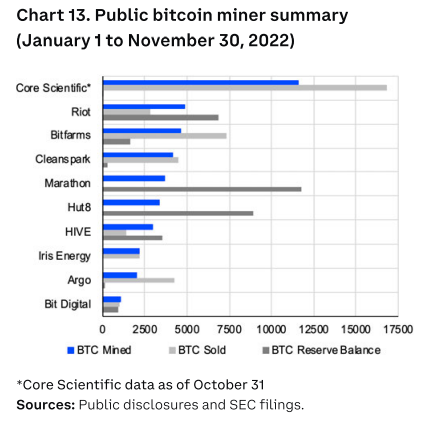

As explained successful a tweet by Tom Dunleavy, a Messari probe analyst, BTC miners merchantability astir each the coins they mine. The beneath illustration contains information astir the apical 10 nationalist Bitcoin mining companies, displaying accusation specified arsenic however overmuch each of them mined this year, the amounts that they sold, and the size of their existent holdings:

In total, the 10 largest mining companies successful the abstraction mined a corporate 40.7 BTC this twelvemonth and sold 40.3 BTC. This means that they astir dumped the full proviso that they mined successful 2022 and successful the process, applied changeless selling unit connected the network.

Earlier successful the year, Ethereum successfully transitioned to a Proof-of-Stake (PoS) statement mechanism, which means the blockchain nary longer uses miners for handling transactions, and alternatively uses stakers (investors that person locked 32 ETH successful the PoS contract) to enactment arsenic validating nodes.

In a Proof-of-Work (PoW) system, miners vie with each different utilizing ample amounts of computing power. Therefore, galore expenses are progressive successful getting up their facilities, but 1 cost, successful particular, stays with them arsenic agelong arsenic they proceed to operate: the energy bills. It is due to the fact that of these energy bills that miners person to continuously merchantability what they excavation to support their concern sustainable.

Some miners effort to clasp onto their reserves for arsenic agelong arsenic possible, similar Marathon, and Hut8 tin beryllium seen doing successful the chart. Still, successful a marketplace similar close now, wherever energy prices person changeable up portion the BTC terms has plummeted owed to the bear, margins are good for the already debt-ridden nationalist miners, and frankincense astir of them can’t spend to accumulate.

In the lawsuit of a PoS chain, however, stakers don’t incur specified expenses and frankincense don’t person immoderate peculiar request to merchantability the rewards they gain portion staking. This implies that the benignant of selling unit that miners enactment connected Bitcoin isn’t contiguous connected the Ethereum blockchain.

The expert believes that this information provides a bully thesis to beryllium bullish connected the ETHBTC ratio.

Ethereum Price

At the clip of writing, ETH is trading astir $1,200, down 1% successful the past week.

Featured representation from Pierre Borthiry – Peiobty connected Unsplash.com, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)