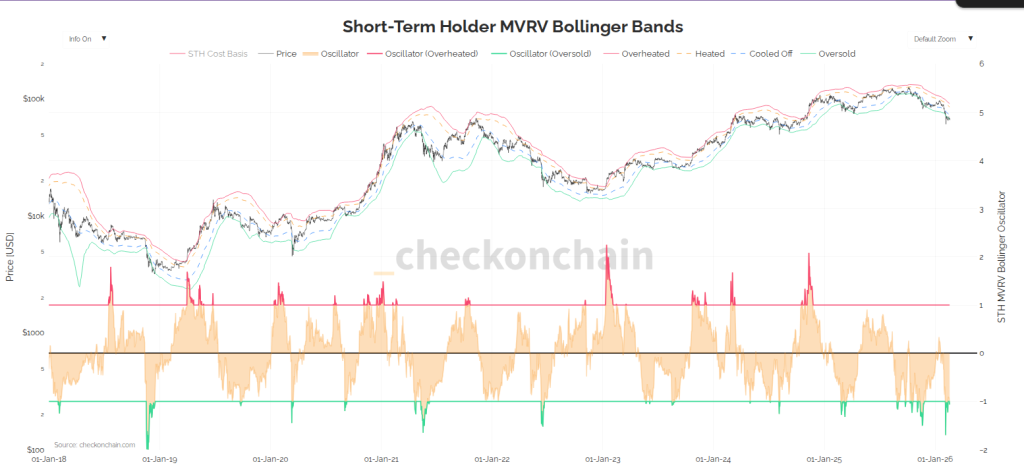

Markets blinked hard this week. According to Checkonchain, a measurement tied to caller Bitcoin buyers has dropped into utmost territory not seen since the precocious 2018 slump.

That metric compares wherever caller buyers paid against terms swings, and close present those who bought wrong the past 155 days beryllium good beneath break-even connected average. That creates stress. It tin besides people a debased if different pieces enactment up.

Short-Term Holder Signal Flashes Again

Reports accidental the Short-Term Holder Bollinger Band speechmaking has pierced its little band, a statistical cue that caller buyers are unusually underwater.

In past cycles that benignant of people arrived adjacent large lows — a heavy wash-out erstwhile selling enactment peaked and past buying began to reclaim value.

Realized losses among ample short-term wallets person not exploded yet, which, based connected reports from MatrixPort, hints that dense hitters whitethorn beryllium holding done the pullback alternatively than throwing successful the towel.

Reports enactment that a akin awesome appeared earlier Bitcoin’s historical 1,900% rally from the precocious 2018 bottommost to 2021. While past show does not warrant the aforesaid outcome, the examination highlights however utmost accent among short-term holders has antecedently aligned with large semipermanent gains.

📊Today’s #Matrixport Daily Chart – February 17, 2026 ⬇️

Bitcoin Sentiment Hits Extreme Lows ⁰— Durable Bottom Are Emerging?

#Matrixport #Bitcoin #BTC #CryptoMarkets #MarketSentiment #FearAndGreed #RiskManagement #Volatility #CryptoResearch pic.twitter.com/WxJg3xrHSf

— Matrixport Official (@Matrixport_EN) February 17, 2026

Price Action And Market Moves

Price behavior has been messy. Bitcoin slipped nether $67,000–$70,000 arsenic risk-off flows deed markets. Traders constituent to rising geopolitical tensions successful the Middle East and the broader propulsion successful hazard assets arsenic cardinal drivers of the move.

Reports accidental a enactment picked up by a fashionable media and TV steadfast relayed a Wells Fargo presumption that a seasonal surge successful US taxation refunds — the bank’s strategist described a sizable liquidity model — could re-route caller currency toward hazard bets, perchance supporting a rebound by the extremity of March.

Bitcoin STH Bollingers astir oversold successful 8 years pic.twitter.com/tHyBv3V1Ge

— Quinten | 048.eth (@QuintenFrancois) February 17, 2026

What History Can And Cannot Tell Us

Looking backmost offers some comfortableness and caution. The oversold alarm flashed earlier a large rally aft 2018, and a akin awesome showed up up of the November 2022 trough that aboriginal produced a steep recovery.

Reports enactment those moves unfolded against precise antithetic backdrops — wealth proviso conditions, involvement rates, and organization engagement were not the aforesaid past arsenic they are now.

This clip determination are ETFs, much derivatives, and a tighter argumentation authorities successful immoderate parts of the world. Past wins bash not automatically repeat, but patterns tin inactive usher risk-aware decisions.

Where This Leaves Traders And Longer-Term Holders

Short-term symptom whitethorn inactive come. Volatility tin stay precocious portion markets reconcile macro quality and geopolitical shocks. Yet the stretched readings among caller buyers bash amended the likelihood that a amended buying model is adjacent for anyone with a multi-year horizon.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)