What looked similar a rebound astatine archetypal glimpse reflected thing deeper; a alteration successful the quality of demand. As integer assets rallied, organization flows became much targeted, and firm equilibrium sheets emerged arsenic a cardinal operator of marketplace structure. Bitcoin roseate 29.8%, reaching a caller all-time precocious successful June, according to CoinDesk Data, but it was the quality of the buyers, not conscionable the size of the move, that marked a turning point. With nationalist companies expanding their BTC holdings by astir 20%, and expanding into assets similar ETH, SOL and XRP, firm treasury adoption has entered a caller phase, with the imaginable to reshape the plus landscape.

Corporate treasuries instrumentality the lead

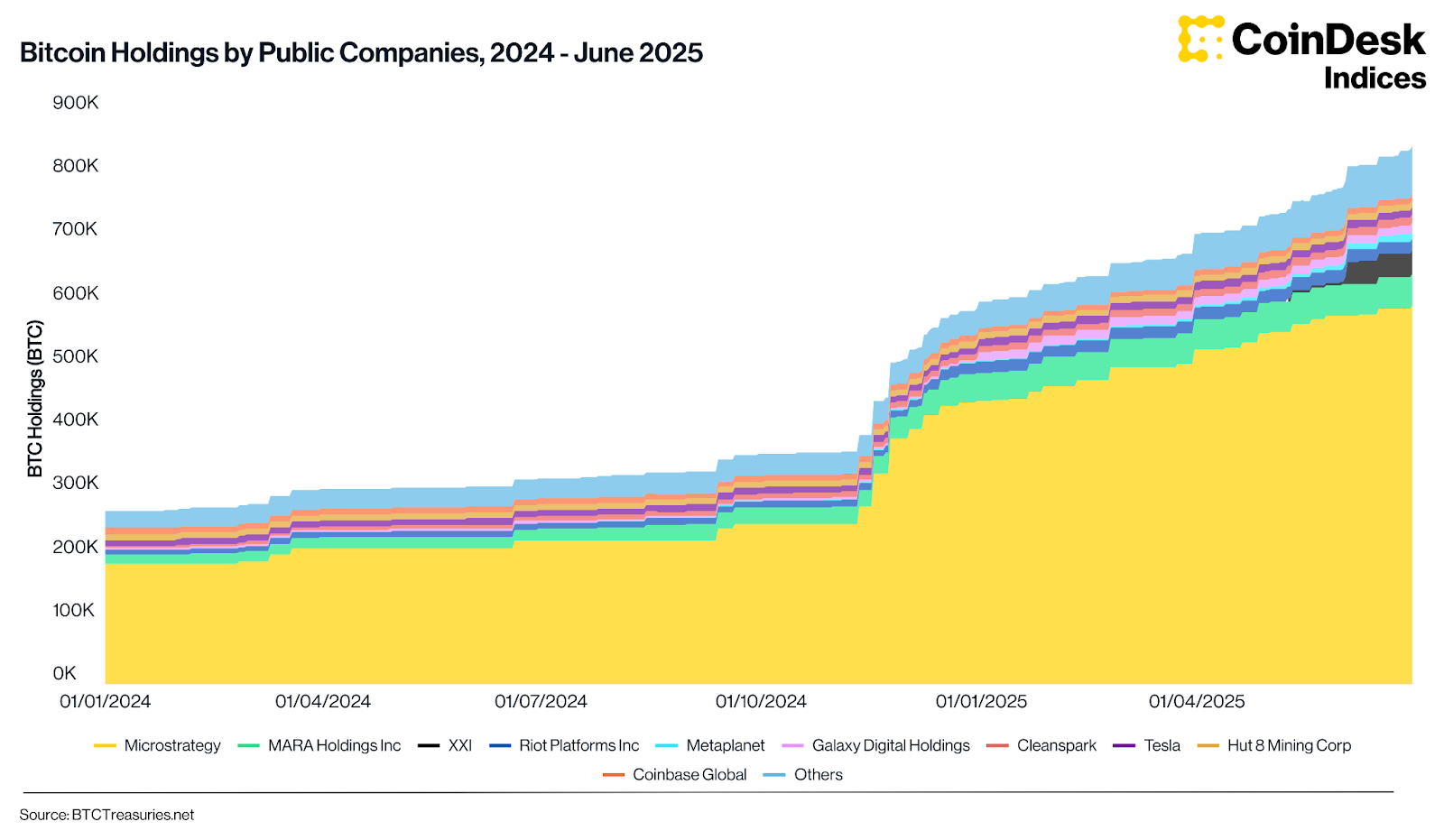

Bitcoin’s show successful Q2 was not led by retail flows oregon leveraged positions. Instead, superior came from firm treasuries. Public companies added astir 850,000 BTC to their equilibrium sheets by quarter-end, marking a 19.6% increase. For the 3rd consecutive quarter, corporates outpaced ETFs successful nett accumulation, reinforcing the displacement successful semipermanent holders. The connection from listed firms was clear: bitcoin is moving from speculation to allocation.

Bitcoin is nary longer the lone plus benefiting from this trend. Public companies present clasp implicit $1.4 cardinal successful altcoins. ETH accounts for the majority, but firms are progressively looking beyond the apical two. Solana has seen firm accumulation, portion TRX, XRP and adjacent BNB are opening to diagnostic successful strategical announcements. Nano Labs, for example, unveiled a $1 cardinal inaugural to accumulate BNB. Meanwhile, Tridentity and Webus.vip are readying important superior raises to enactment XRP buys. This level of activity, antecedently confined to BTC, is present spreading crossed the broader market.

ETH reclaims marketplace share, Aave tops scale rankings

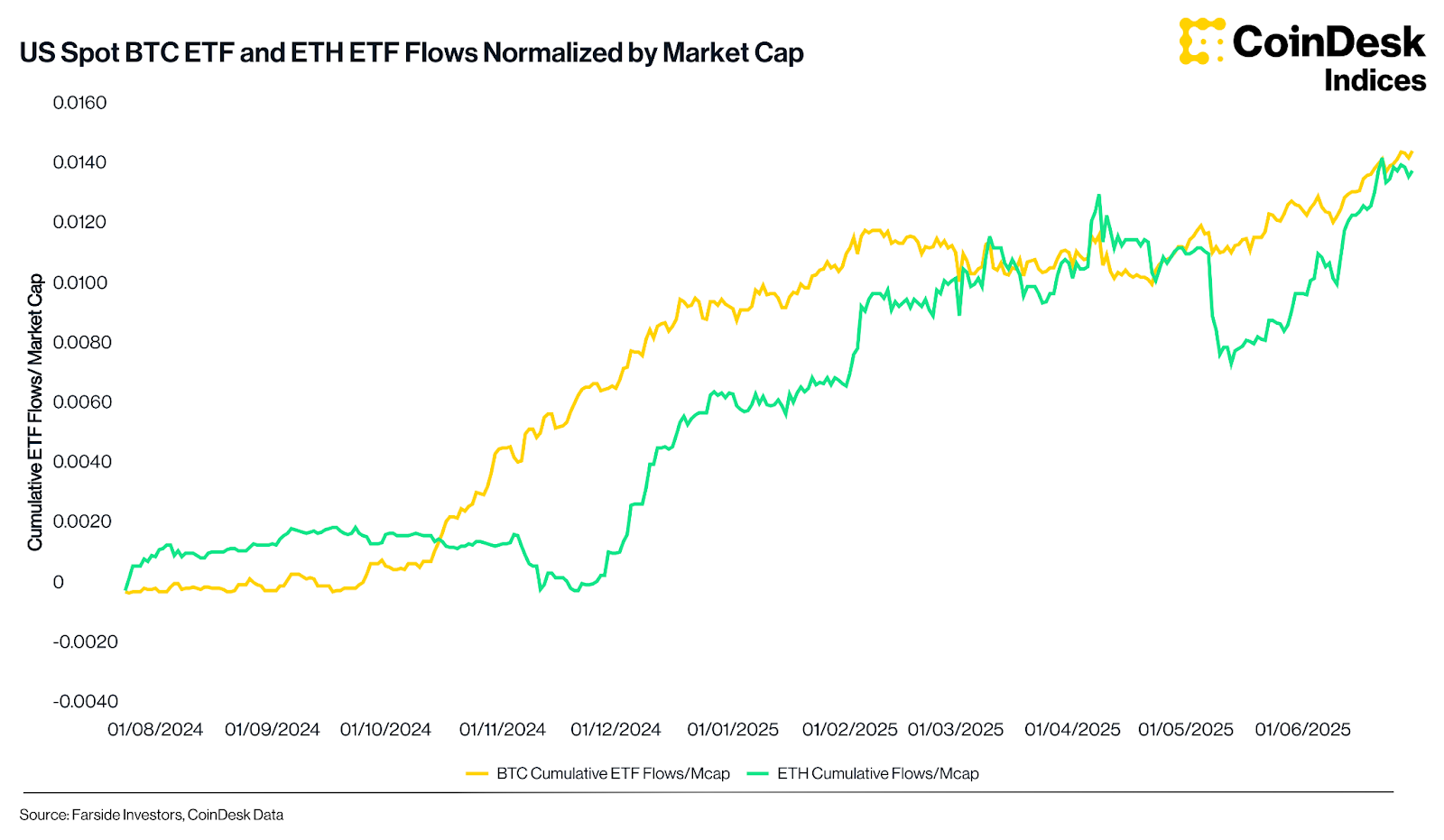

Ethereum, which had lagged successful earlier quarters, reclaimed its footing with a 36.4% emergence successful Q2, CoinDesk Data shows. Flows into ETH ETFs turned positive, and person present remained truthful for 8 consecutive weeks. Adjusted for marketplace cap, these flows are astir connected par with BTC, marking a convergence successful sentiment. The 30% uplift successful ETH/BTC hinted astatine a strategical rebalancing, with allocators rotating backmost into ether.

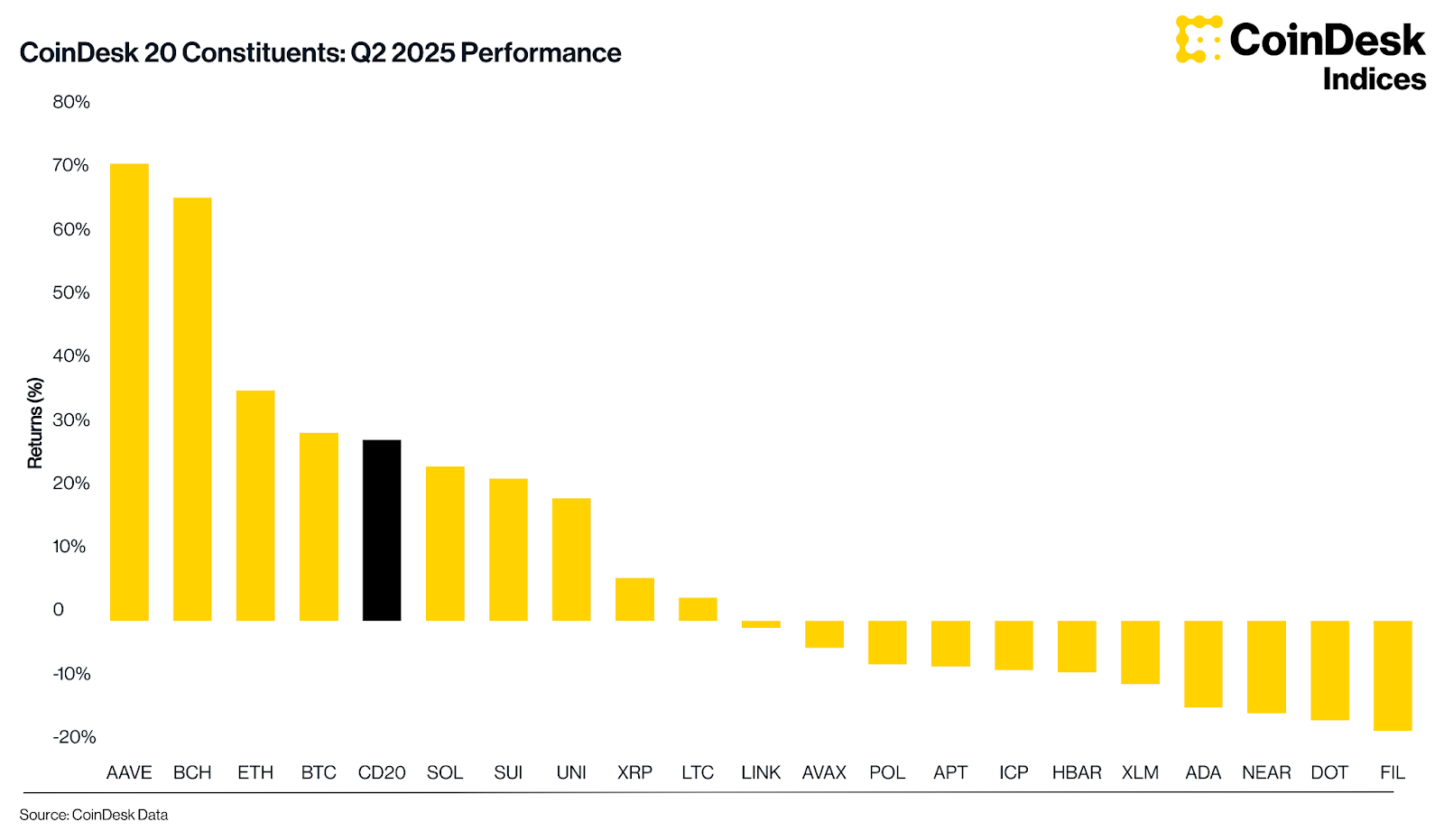

Beyond ETH, Aave delivered the strongest show wrong the CoinDesk 20 Index, gaining 72% successful the 4th based connected CoinDesk Data, arsenic lending enactment deed all-time highs and vePENDLE collateral was added to the protocol. Institutional relevance is opening to instrumentality signifier present too. The upcoming Aave v4 upgrade, on with the Horizon inaugural aimed astatine tokenised real-world assets, positions the protocol for greater adoption beyond crypto-native circles.

Solana keeps pace, but loses spotlight

Solana returned 24.3% successful the quarter, according to CoinDesk Data, and retained its presumption arsenic the starring concatenation by application-level revenue. However, it underperformed some bitcoin and ether. Despite coagulated fundamentals, capitalist flows were directed elsewhere. Capital concentrated successful assets with much mature ETF infrastructure and longer-established treasury narratives. Even the motorboat of the REX-Osprey Solana staking ETF, which attracted $12 cardinal connected its debut trading day, was not capable to reignite momentum.

That said, capitalist involvement is inactive building. The caller Pump.fun token procreation event is drafting attraction from some ends of the spectrum. On 1 broadside are speculative participants, portion connected the different are value-driven investors assessing the project’s gross potential. Treasury enactment besides continues to rise, with implicit 1 cardinal SOL present held by corporations specified arsenic SOL Strategies and DeFi Development Corp.

Narrower gains, clearer signals

The 2nd 4th confirmed what the archetypal 4th had suggested: enactment successful integer assets is narrowing, and the marketplace is rewarding clarity. The CoinDesk 20 Index roseate by 22.1%, though lone 4 constituents outperformed it: Aave, bitcoin cash, ether and bitcoin. The CoinDesk 80 declined by 0.78%, portion the CDMEME Index ended the 4th up 27.8% contempt a 109% spike successful May (based connected information from CoinDesk Indices). Outside the majors, astir assets lacked accordant inflows oregon structural support, leaving them prone to retracements.

Bitcoin and ether some saw their scale weights diminution by implicit 5 percent points. This made abstraction for assets that posted stronger returns, but it did not meaningfully alteration the creation of leadership. Aave and BCH inactive correspond a tiny fraction of the index, reflecting the world that outperformance unsocial is not capable to displacement structural weightings. Liquidity and credibility stay prerequisites.

Benchmarks arsenic allocation tools

As adoption broadens and firm behaviour becomes much worldly to terms action, benchmarks are playing a much progressive relation successful superior decisions. With much than $15 cardinal successful cumulative trading measurement since launch, the CoinDesk 20 is present some a measurement of marketplace absorption and a instauration for gathering structured exposure.

The rally successful Q2 was real, but much importantly, it was orderly. Allocators are not trend-chasers. They are gathering frameworks. Benchmarks, indices and ETFs are astatine the centre of this evolution. As integer assets determination from the edges of portfolios to their core, tools that bring subject and operation go progressively important.

For afloat show details and constituent analysis, you tin research the Q2 Digital Assets Quarterly Report.

Disclaimer: All price, scale and show figures references are sourced from CoinDesk Data and CoinDesk Indices unless stated otherwise.

5 months ago

5 months ago

English (US)

English (US)