Previous research conducted by CryptoSlate suggested the Ethereum Merge would beryllium a buy-the-rumor, sell-the-news event.

With that coming to pass, arsenic ETH sunk 20% implicit the past 7 days, what does a existent investigation of the derivatives marketplace reveal?

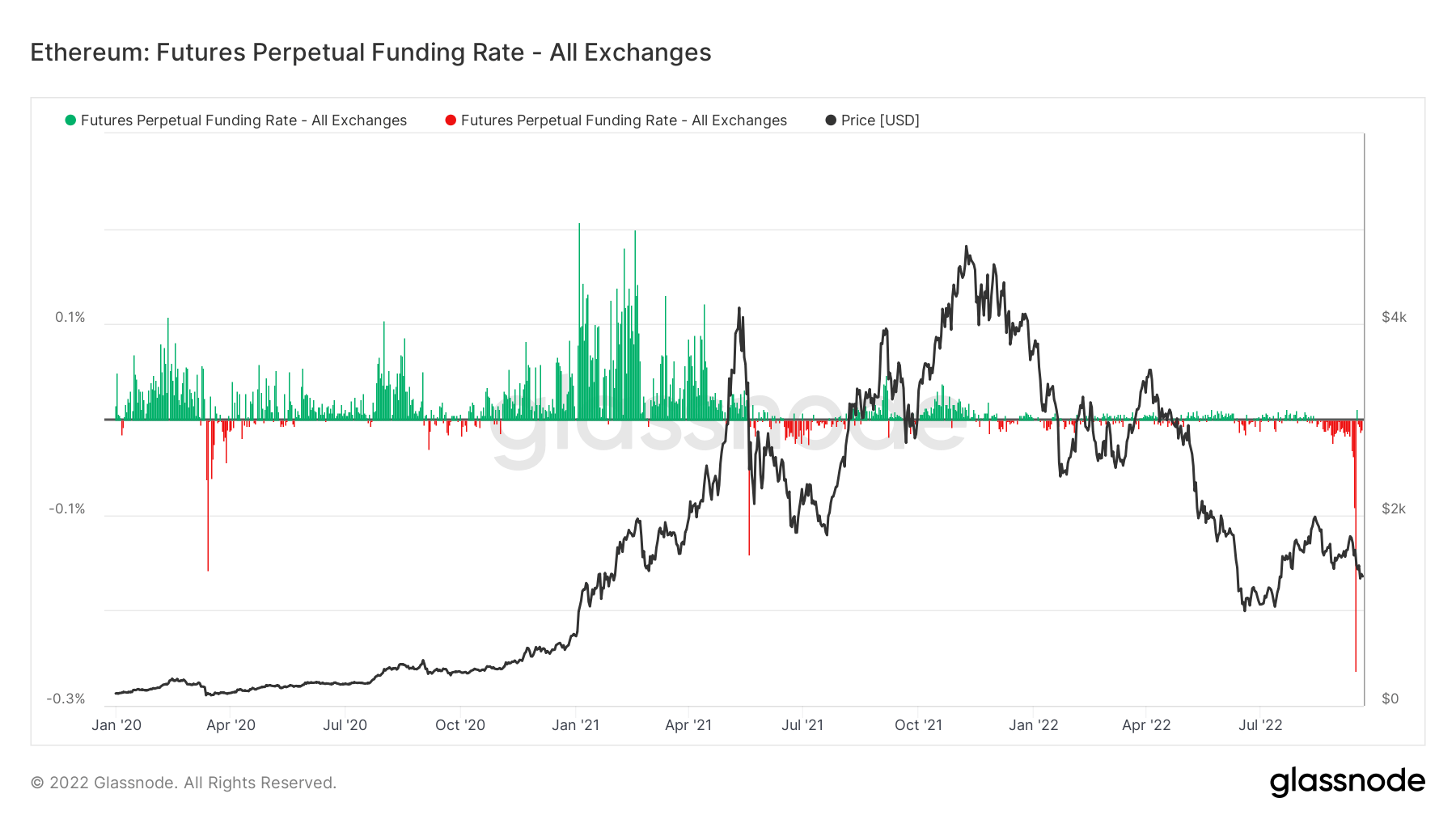

Ethereum Futures Perpetual Funding Rate

Perpetual Funding Rates notation to periodic payments made to oregon by derivatives traders, some agelong and short, based connected the quality betwixt perpetual declaration markets and the spot price.

During periods erstwhile the backing complaint is positive, the terms of the perpetual declaration is higher than the marked price. Therefore, agelong traders wage for abbreviated positions. In contrast, a antagonistic backing complaint shows perpetual contracts are priced beneath the marked price, and abbreviated traders wage for longs.

They disagree from modular futures contracts successful that the perpetual constituent means traders tin clasp positions without the declaration expiring. But the intent of backing rates is to service arsenic a mechanics for keeping declaration prices successful enactment with spot markets.

The illustration beneath shows that arsenic the Merge approached, traders were paying astir 1,200% annualized backing rates to abbreviated Ethereum. The standard of shorting surpassed the levels seen during the tallness of the covid crisis.

Post-Merge, the backing complaint has reverted to adjacent neutral, suggesting short-term speculation is over, and the backing premium has vanished accordingly.

Source: Glassnode.com

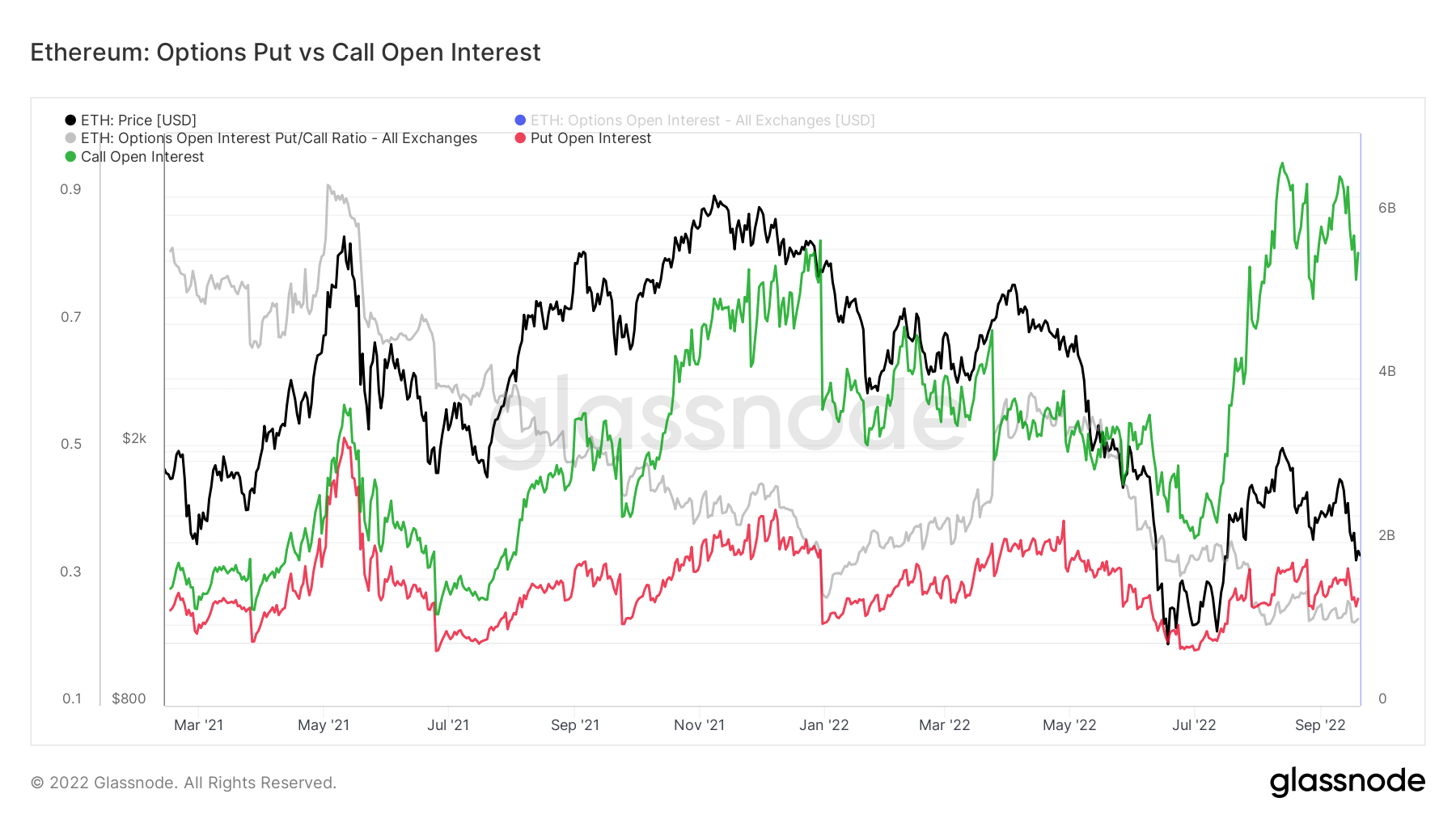

Source: Glassnode.comOptions Put vs. Call Open Interest

Open Interest refers to the fig of progressive options contracts. These are contracts that person been traded but not yet liquidated by an offsetting commercialized oregon assignment. A enactment enactment is the close to merchantability astatine a circumstantial terms by a specified date, whereas a telephone is the close to bargain astatine a peculiar terms by a specified date.

The illustration beneath showed some enactment and telephone options person sunk post-Merge. Calls stay elevated, with much than $5 cardinal inactive successful force, whereas puts stay comparatively muted.

This suggests traders are inactive consenting to spell agelong contempt the post-Merge terms correction.

Source: Glassnode.com

Source: Glassnode.comThe station Research: State of Ethereum derivatives marketplace post-Merge appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)