The carnivore marketplace rhythm is successful afloat effect, and these bits of information from the mining assemblage exemplify the effects of a depressed bitcoin market.

Bitcoin’s terms is down astir 70% from its latest all-time high, and the mining assemblage is feeling the afloat value of the ongoing carnivore market. Lots of fear, uncertainty and uncertainty (FUD) often dispersed acold and wide astir miners during carnivore markets, but the information astir however these operators are affected and behave successful this situation is simple. This nonfiction outlines six cardinal information sets that exemplify the effects of the carnivore marketplace connected bitcoin miners and their operations.

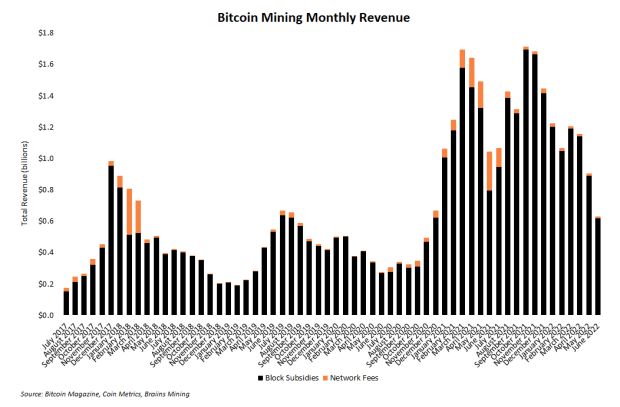

Monthly dollar-denominated gross is simply a hallmark metric that signals the authorities of the mining sector. In bearish marketplace conditions, miners expect gross to drop, and the beneath barroom illustration illustrates this is precisely what is happening. Primarily this metric is falling due to the fact that of a cheaper bitcoin terms quoted successful dollars. In fact, monthly mining gross successful June is acceptable to grounds its lowest level successful 18 months. From August 2021 to April 2022, moreover, miners enjoyed a comfy nine-month streak of astatine slightest $1 cardinal successful full sector-wide revenue. May ended that streak, and gross continues dropping successful June.

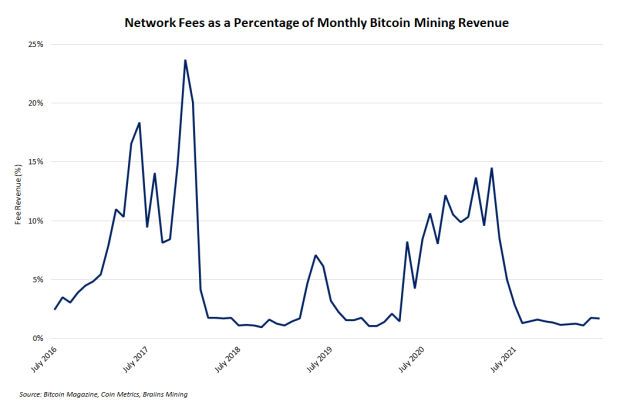

Digging deeper into mining revenue, transaction fees are an important (and hotly debated) class of revenue. Many bitcoin advocates and critics alike reason that a beardown interest marketplace is captious for Bitcoin’s semipermanent success. And during bullish marketplace conditions, fees mostly represent a important percentage of monthly mining revenue. But carnivore markets historically obliterate this gross stream, and the existent marketplace conditions are nary exception. From August 2021 to May 2022, fees represented astir 10% to 15% of monthly gross — but since August, that fig has hovered astir 1 percent. In fact, since August, fees person not represented much than 2% of monthly mining gross arsenic shown successful the enactment illustration below.

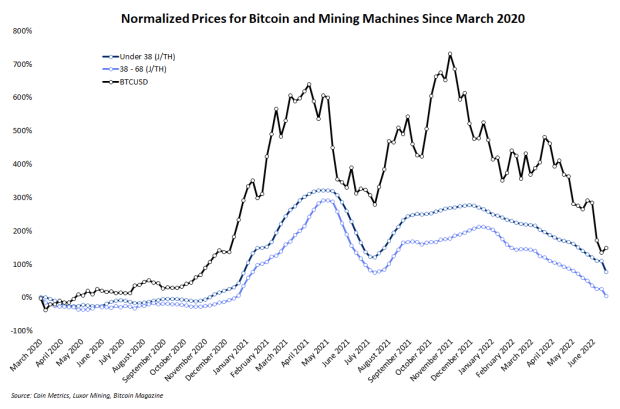

Mining machines person a precise beardown affirmative correlation to the terms of bitcoin, and carnivore markets often origin prices for these machines to driblet precipitously. There are respective causes for this relationship, including repricing based connected existent gross produced per instrumentality and immoderate basal intelligence factors unsocial to the mining sector. Curiously, instrumentality prices thin to lag down bitcoin erstwhile the marketplace sells off, and the beneath enactment illustration illustrates this dynamic. Year-to-date, prices for mining machines crossed assorted levels of ratio and profitability person dropped by 50% to 60% astatine the clip of writing. If bitcoin’s terms continues to dip, the mining hardware marketplace volition surely follow.

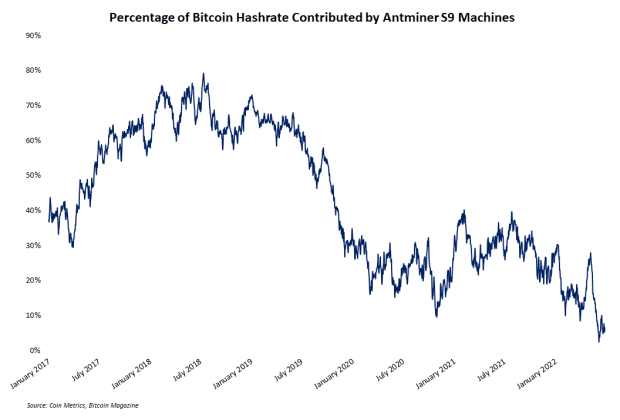

Not lone are hardware prices dropping, but older machines are being squeezed retired of the marketplace altogether arsenic economically rational miners are forced to powerfulness down little businesslike hardware to debar mining bitcoin astatine a terms higher than the marketplace is consenting to wage for it. This effect is astir intelligibly seen successful the stock of hash complaint contributed by Antminer S9s, an aged procreation of instrumentality developed by Bitmain. Compared to a 35% stock of hashrate coming from these machines 1 twelvemonth ago, S9s present lend hardly 5% of full hashrate, according to Coin Metrics information shown successful the illustration below. “At these BTC prices, the S9 erstwhile again looks similar scrap metal,” said Coin Metrics expert Parker Merritt.

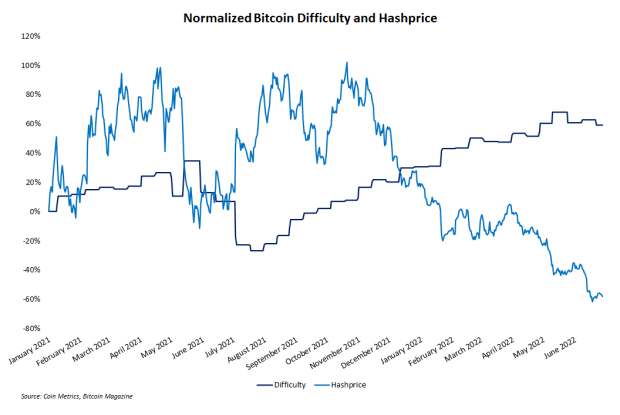

The astir precise metric for tracking mining gross is hash price, which measures the dollar-denominated gross per portion of hashing powerfulness energized per 2nd per day. This metric often fluctuates autarkic of price, and it tin spell down adjacent erstwhile the terms of bitcoin goes up. The illustration beneath shows maturation successful mining trouble and plummeting hash terms since aboriginal 2022. In fact, precocious June saw hash terms driblet beneath $0.10 for the archetypal clip since precocious October 2020. Yet different grounds of bearish marketplace conditions making beingness much hard and little profitable successful the mining sector.

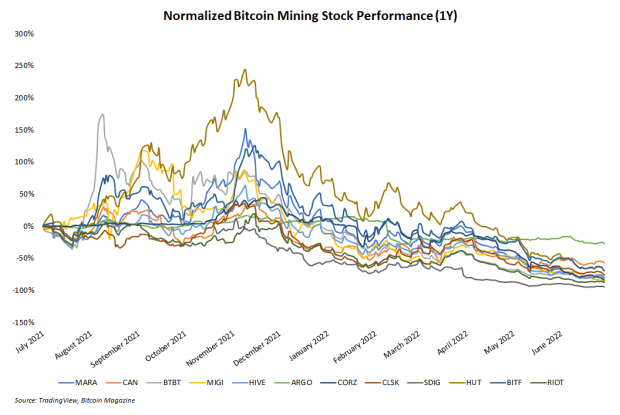

Collapsing stock prices for publically traded mining companies is astir apt the strongest awesome of existent marketplace conditions. For each the reasons mentioned above, astir mining companies are holding importantly devalued physically mining assets, operating with tightening nett margins and earning a overmuch cheaper integer plus arsenic bitcoin’s terms drops. But mining stocks besides thin to enactment arsenic a high-beta play to bitcoin’s price, truthful erstwhile the bitcoin terms moves either up oregon down, prices for shares of mining companies acquisition adjacent larger moves successful the aforesaid direction.

The enactment illustration beneath shows the normalized one-year show of a twelve antithetic mining companies that commercialized connected the Nasdaq. Almost each institution is down astatine slightest 60% implicit that period, astatine the clip of writing, with the worst performer — Stronghold Digital Mining — down 94%. Times are pugnacious for bitcoin miners … and their shareholders.

In bearish conditions, the bitcoin markets often look to miners to gauge whether sentiment is stabilizing oregon worsening. Miners selling coins, unplugging machines, oregon liquidating hardware are each signs that, yes, conditions are bad. But yet each this information follows the terms of bitcoin alternatively of affecting the terms of bitcoin. So, erstwhile immoderate of the supra information sets volition amended is an unfastened question — it depends connected erstwhile the bitcoin marketplace levels retired oregon turns bullish. Until then, miners proceed operating according to their existing plans for surviving different agelong carnivore market.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)